Greetings giant tipped as ‘wise time to invest’, citing new ceo’s changes

Greeting cards have been tipped as a good investment with The Sunday Times highlighting IG Design Group as its share of the week.

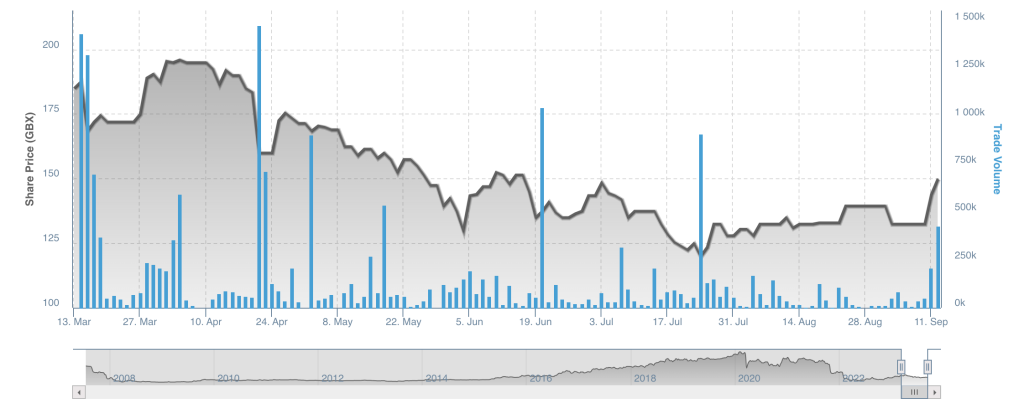

Under the headline ‘IG Design could be a gift for investors’, the newspaper’s tipster Lucy Tobin touted the greetings, stationery and wrap giant as a good bet in the edition on Sunday, 10 September, saying that with shares 80% down at £1.30 from the 2018 high of over £6 “very early signs of a turnaround suggest that now could be a wise time to invest”.

She described the company as: “One of those firms whose products are found in most homes yet still flies under the radar. The stationery and gifts business produces more than a billion metres of wrapping paper every year, makes paper twist carrier bags for High Street brands such as Schuh, brings out the kind of themed party wear that Instagrammers gorge over, and is one of the big players in greetings cards.”

With its head office in Newport Pagnell, and large manufacturing operation in Hengoed, South Wales, IG Design Group is the world’s largest consumer gift packaging business and a designer, innovator and manufacturer of products across five major categories – celebrations, gifting, craft and creative play, stationery, and not-for-resale consumables – working with more than 11,000 customers in over 80 countries throughout the UK, Europe, Australia and the US.

Having seen sales of over 220m greeting cards in the past year, the company is also working hard on the sustainability front and at this year’s PG Live showcased its Eco Nature range that’s fully recyclable and made from recycled materials.

However, since the 2016 rebrand from International Greetings, the company that’s listed on the London Stock Exchange’s Alternative Investment Market (AIM) international sub-market for small and medium-size growth companies, had seen shares plummet.

While the Covid pandemic didn’t help with all parties cancelled and most stores closed, including the 210,000 retailers worldwide who stock IG products, for nigh-on a year, the tipster flagged up “questionable deal-making” as part of the reason for the problems, including buying two US firms for almost £200million between 2018 and 2020 which “left IG exposed to the whims of the US retail giants” just before soaring inflation and freight costs, leading to two profit warnings.

Following Paul Fineman citing personal reasons for stepping down suddenly in February 2022 after 17 years with the business, the last 14 as group ceo, Paul Bal arrived as chief financial officer on 1 May, 2022, then was appointed chief executive on 1 April this year, with Rohan Cummings joining as cfo on 3 July.

The Sunday Times said the pair has refinanced a three-year £100m ($125m) banking facility, restructured the US business and cut net debt by £32m ($40m) – some of which was made possible by axing the dividend.

The tipster said: “The firm’s order book now looks decent at 62% of budgeted revenues, while unprofitable contracts are being excised in the US. Results for the year to April showed the operating profit margin was at last rising, albeit just to 1.8% and still miles off the 7% margin seen before Covid. Still, the board restated its target for IG Design’s margins to hit pre-pandemic levels by 2025.”

While sales are still down 8% in the year, she added “some of the red flags over IG Design are fading” with the interest bill covered more than twice by operating profit and an anticipated full-year loss avoided.

From a low of 69.40p in October last year shares did hit 196.00 in April, then were 132.50 on Friday and rose to 144.0 on Monday immediately after the Sunday Times tip, and were up again at 150.00 yesterday with the price steady as at 8am this morning.

And she concluded: “There are plenty of caveats but, if the turnaround carries on and the dividend once again approaches the 9p pay-out in 2019, the current share price will look a bargain. Take a deep breath – and buy.”