Trading statement reveals volume growth over Christmas, Valentine’s and Mother’s Day

A “strong performance” at Moonpig is underpinning the group’s results as the financial year draws to a close at the UK and Netherlands online greeting card and gifting platform.

The announcement yesterday, 14 March, saw the group – comprising Moonpig, Red Letter Days and Buyagift in the UK and Dutch brand Greetz – state its trading performance has remained in line with expectations across all brands, adding: “Growth has been underpinned by strong performance at Moonpig, which saw volume growth across the Christmas, Valentine´s Day and Mother´s Day peak trading seasons.”

And ceo Nickyl Raithatha commented: “We are delighted revenue remains in consistent growth at the Moonpig brand. Our continued focus on technology investment means Moonpig Group is now consistently delivering year-on-year growth in revenue and profit.

“This is underpinned by our resilient, profitable and cash generative business model, leveraging our unique use of data to drive customer loyalty. We continue to innovate to attract and retain our loyal customers and remain well positioned to benefit from the long-term structural market shift to online.”

It was revealed that the group has repaid its £175million loan and £80m revolving credit facilities (rcf), and a new £180m four-year, committed, multi-currency rcf agreed with a syndicate of banks.

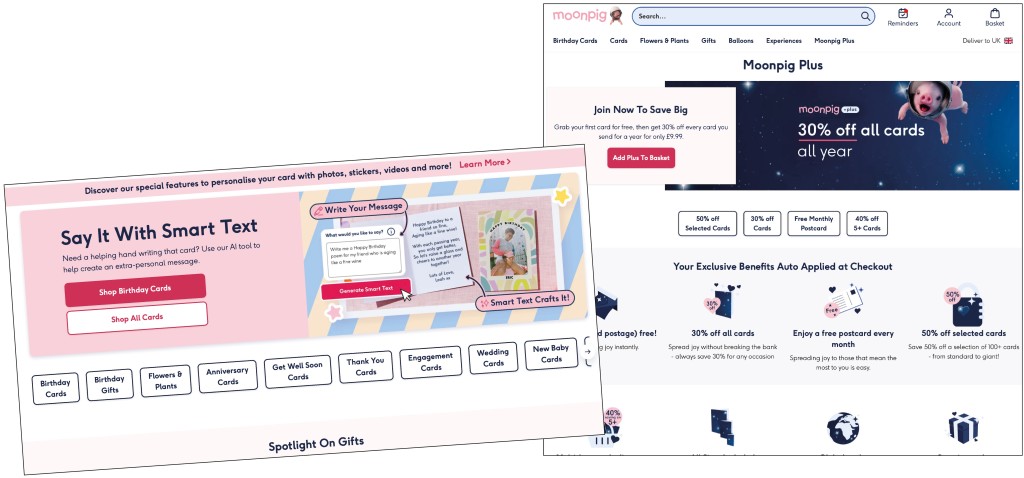

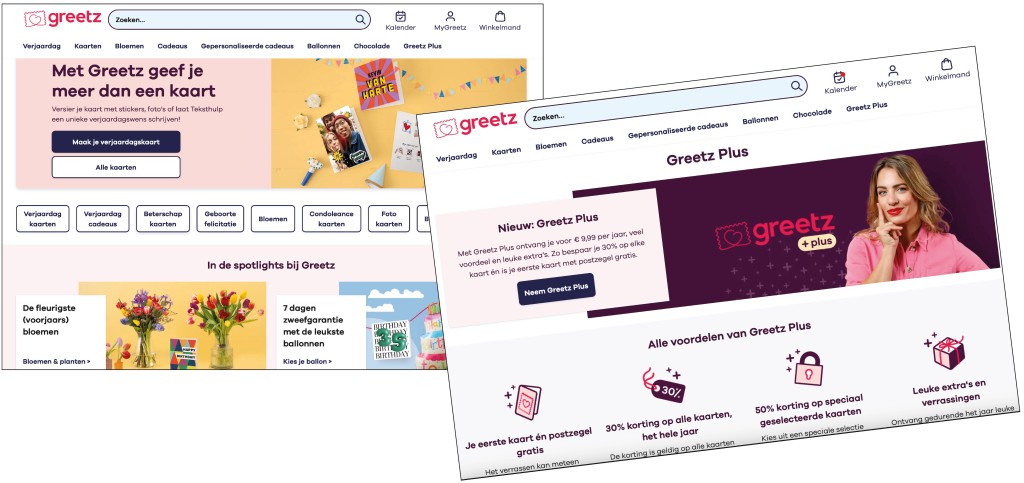

The statement said the company continues to make good progress with the deployment of customer-facing technology features – nine months following its launch, the Moonpig Plus subscription membership service has over 250,000 subscribers and Greetz Plus has been well received by Dutch customers since it was introduced in January 2024.

It added: “During the financial year to date, customers have used our innovative card creativity features to enhance nine million personalised greeting cards, bringing them to life with audio and video messages, stickers, digital gift experiences and AI-generated message inspiration.”

The board added that, while the external environment remains challenging, expectations for full-year revenue and adjusted earnings before interest, tax, depreciation and amortisation (ebitda) remain unchanged, as the financial year ends on 30 April.