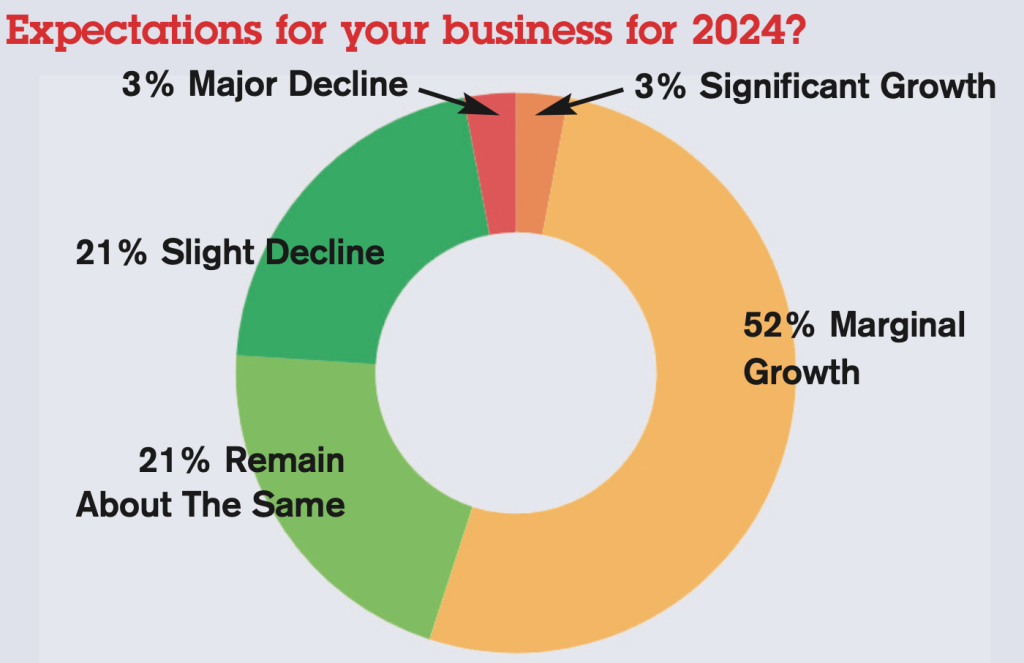

Over 55% of greetings retailers expect to grow their business this year

Independent greeting card retailers have started 2024 feeling a lot more optimistic than they were this time 12 months ago, with over half expecting to grow over the year, according to the findings of the latest PG Retail Barometer.

This comes on the back of 47% reporting that trade was up last year compared to 2022, with the continued shop local drive cited as having been the biggest boon to takings while the cost-of-living crisis and postal issues topped the list of banes to trade.

Broadening their selection of gifts came up trumps for many respondents, knocking greeting cards off the second slot as having made the most positive contribution to their trade in the last year.

That said, cards weren’t far behind in third position, continuing to hold their own as a very relevant and tangible way of communicating with loved ones – almost a third of respondents believe the consumer’s appreciation of greeting cards grew over the last year, and that’s following of from the Covid years when they saw a huge jump.

Engagement with customers through social media as well as other promotional activities also made a big difference to indies’ trade.

Among the many insights into the independent greeting card retail sector from the latest annual survey, is that humorous cards was the top performing greeting card category.

Christmas card singles took the second slot as the area that has grown the most year-on-year, a reflection that 27% of their customers sent more Christmas cards in 2023 compared to the year previous with the GCA #Cardmitment campaign coming in for some praise.

In response to what one word best describes the industry today, it was “vibrant” that came out tops, with “resilient” and “challenging” not far behind.

“It’s encouraging that the Barometer readings show a boost in confidence for the year ahead,” commented Jakki Brown, md of Max Publishing which undertakes the independent research every year. “Clearly indies’ tenacity, engagement with their customers, social media and collaborative activity as well as improvements in their product selection have borne fruit.”

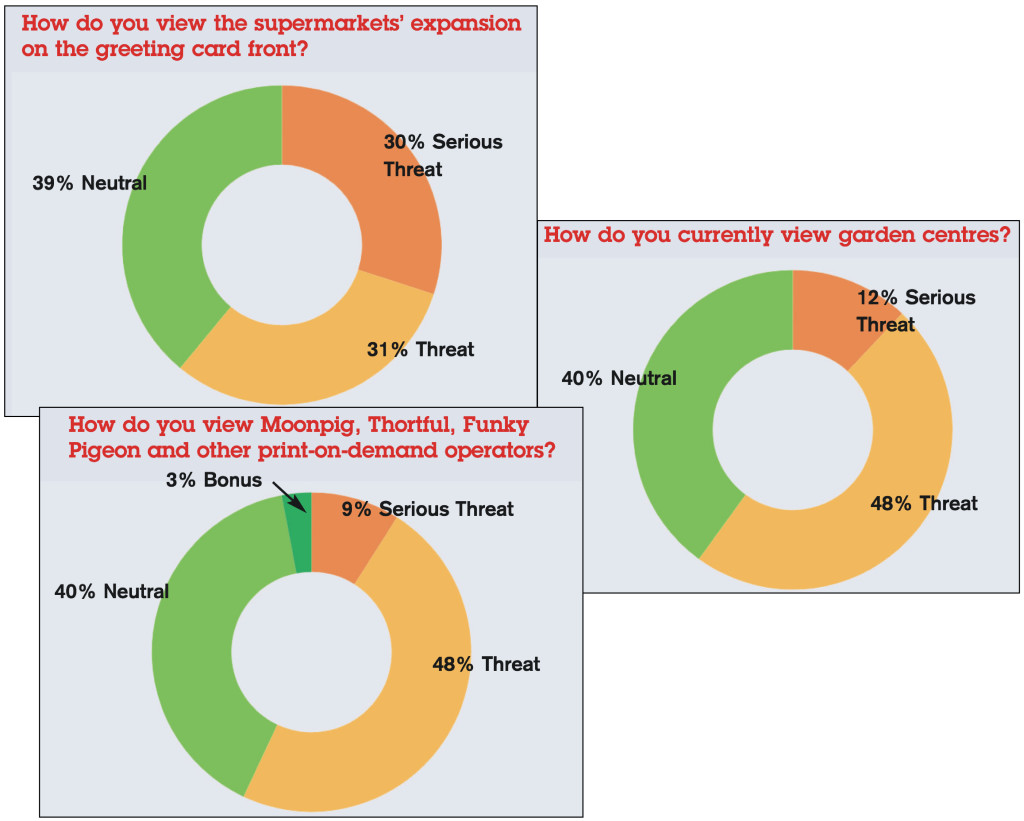

As for which other retail types indies see as the biggest threats to their business, it’s still supermarkets that clinch it, with 30% of indies going so far as to see them as a serious threat, while garden centres, Cardfactory and Amazon have crept up to be viewed as substantial bugbears to their trade.

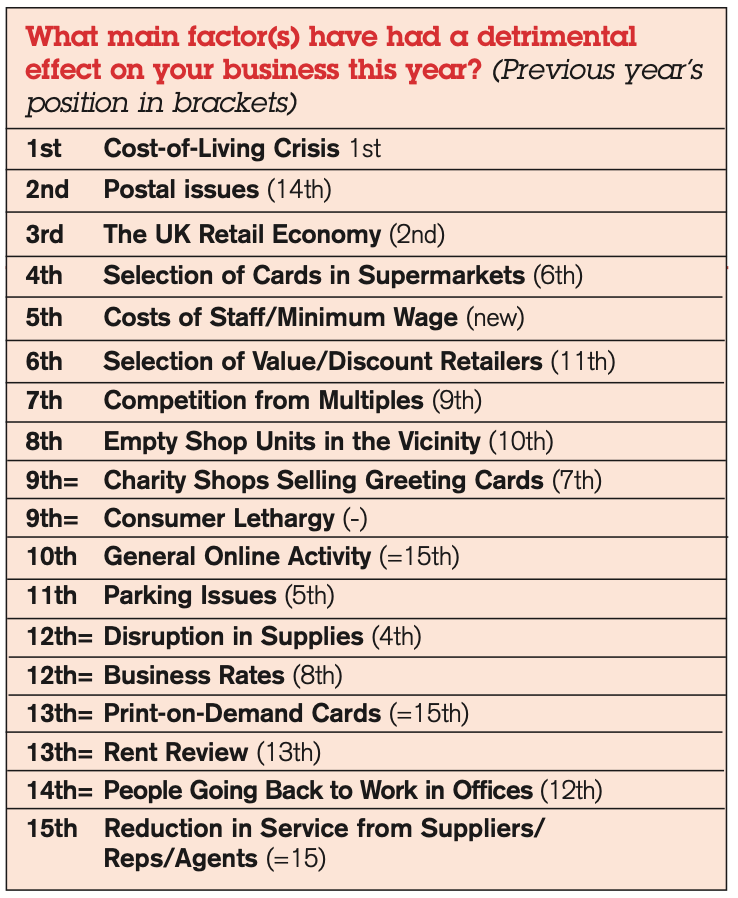

The all-encompassing cost-of-living crisis was, for the second year running, the top reason indies cited as having had a detrimental effect on their business over the last year.

Postal issues made a huge jump up the list of biggest banes, into second spot, with the hangover of the postal strikes of 2022, increase in the cost of first-class stamps and a general drop in confidence over the postal service having a dampening effect on an indie’s business.

Overheads, notably staff costs have made things tricky for many indies while, thankfully, supplier issues were less damaging than a year previous – and the Covid word did not make an appearance.

A fuller report appears in PG’s February edition, to read it click here.