Data shows positive increase forecast for Christmas despite still-cautious consumers

Signalling good news for greeting card retail stockists based in the centre of major conurbations, footfall across UK retail destinations strengthened marginally last week from the week before, with the signs pointing to employees gravitating back to their offices.

The data from retail intelligence and shopper analytics firm Springboard shows that, while consumers are clearly still being cautious, footfall in larger cities across the UK rose by twice the High Street average, with an even greater uplift in Central London although in market towns and Greater London, which have become strong indicators of the extent of home working, footfall was not nearly as strong.

However, this stronger performance was the result of a bounce back in footfall on Wednesday 12 October, meaning it had strengthened from 2021 across all three key destination types last week, and the gap from the 2019 level narrowed, whereas it had plummeted in the week before last due to rain.

Springboard marketing and insights director Diana Wehrle said: “Excluding this one day, footfall was flat from the week before, a strong indicator of the cautiousness of consumers in the light of the current economic challenges. This cautiousness is particularly apparent in a drop in footfall across all three key destination types on Saturday, the peak trading day of the week.”

She added that the increase in office working last week will have supported footfall across the UK, and in both High Streets and shopping centres it had risen in six of the 10 UK geographies while in retail parks, which are further away from office location, footfall declined in all but one area of the UK.

Springboard’s September report, covering the four weeks to 1 October, showed that hybrid working is impacting the recovery of footfall in High Streets as well as the challenge of inflation. With around a half of all employees continuing to work at home for at least part of the working week activity in High Streets remains significantly lower than in 2019, particularly during the Monday to Friday period.

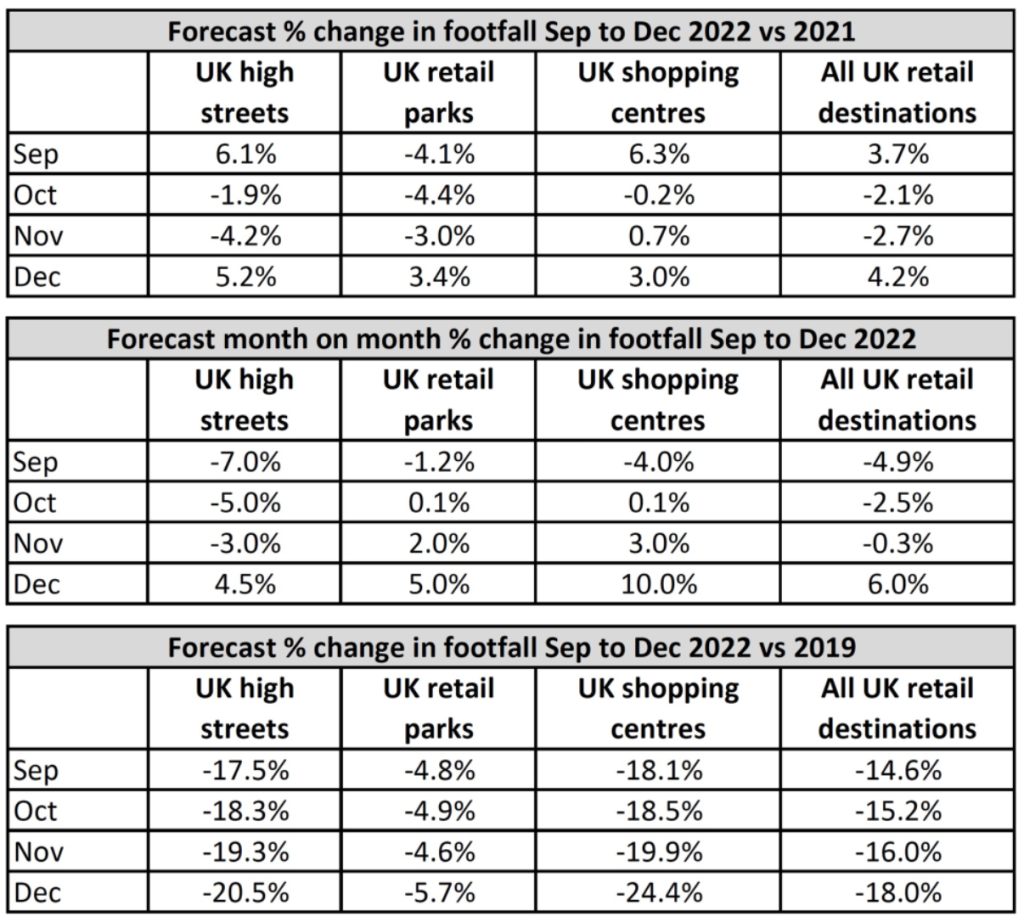

Meanwhile, Diana’s forecast for footfall in Q4 shows the economic challenges from increased energy and fuel prices will start to bite in earnest from now, and the expected drops in footfall will only increase in the month’s run-up to Christmas.

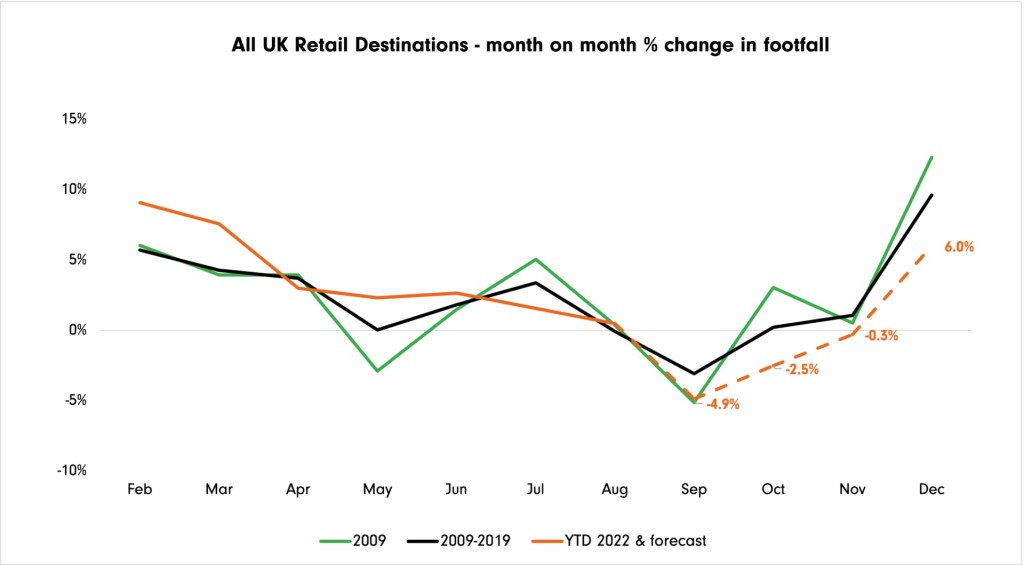

“Footfall across all UK retail destinations is forecast to decline on a month-to-month basis by 2.5% in October and by 0.3% in November, but then increase in December by 6%,” said Diana.

The forecast is based on accumulated data since 2009, showing a dip every September due to a drop in consumer demand following the summer holidays and start of the new school term, as well as November footfall slightly decreasing from October’s numbers mainly due to consumers leaving High Streets for shopping centres over the Black Friday trading period.

Diana added: “The drop in footfall in November this year will be mitigated by shoppers being likely to use the discounts available over the Black Friday period to buy Christmas presents with the hope of outrunning inflation.

“Footfall will rise from November to December, as it does every year due to the Christmas trading period, but the uplift is forecast to be more subdued than in previous years as consumers will be constrained in terms of available budget.”

Springboard’s forecast has footfall rising in all three destination types from November to December – by 4.5% in High streets, 5% in retail parks, and 10% in shopping centres, which are the destination of choice for many shoppers when shopping for Christmas, due to the range of products that are available.

The company expects the monthly impact to show footfall will be lower than last year at 2.1% below 2021 in October and 2.7% in November, but in December it will return to positive territory with a rise of 4.2% from a year previous.

Top: Crowds may return for Christmas shopping