Some help possible for indies as PM frontrunner looks to raise business property tax limits

Tory leader hopeful Liz Truss looks likely to bring relief to many small firms, including independent greeting card retailers, by increasing business rates relief.

According to Retail Gazette today, 1 September, the scheme is believed to involve expanding rates relief from premises with a rateable value of £15,000 to those up to £25,000, meaning many thousands more companies would be spared from the property tax – a helpful move with the severe increase in energy costs.

The frontrunner for the Conservative Party leadership, which could see the current Foreign Secretary made Prime Minister next week, Liz’s team has been discussing the proposals with industry lobbyists, and Chancellor Nadhim Zahawi has also met with business group representatives amid widespread calls for reform.

However, the possible changes won’t help every indie retailer, as Sean Austin, owner of Malvern’s Austin & Co, explained: “As the owner of a shop with a rateable value below £12,000 a year, there would be no savings to me, similarly for any businesses out there with a rateable value of over £25,000 a year. We’ll all still be paying the same amount for our fuel and have no potential savings from elsewhere to pay for any increases – the only winners proportionately would be those in the £15,001 to £25,000 range.”

And in Leicester, Set owner Stuart Delahoy said: “It doesn’t help us I’m afraid – don’t forget there are a lot of High Street shops like us who won’t benefit. We have a 1,000sq ft store and our rateable value is £51,500 so initially it will help our competitors who are off the High Street areas in smaller shops. I don’t begrudge them any help at all but don’t forget there are a lot of us who are employers keeping the economy going and we need some help as well.

“The rate relief over the last couple of years has been a life-saver – but when my rates go back up to £26-28,000 it will be a bitter pill to swallow. With energy costs, we have to put prices up because suppliers are putting prices up – but we’re maintaining a static margin. The only way we can pay for increased utility bills is if our turnover increases, ours actually has done but it’s a tough ask in this market.”

Mark Janson-Smith, md and co-owner of Postmark’s six London stores, added: “Without the full details of what is proposed it’s hard to get too excited about it but, obviously, any help is appreciated in these times when everything is only going one way. As it currently reads, around half of our estate should hopefully qualify which would be a big help towards the increase in energy bills we’re all facing.”

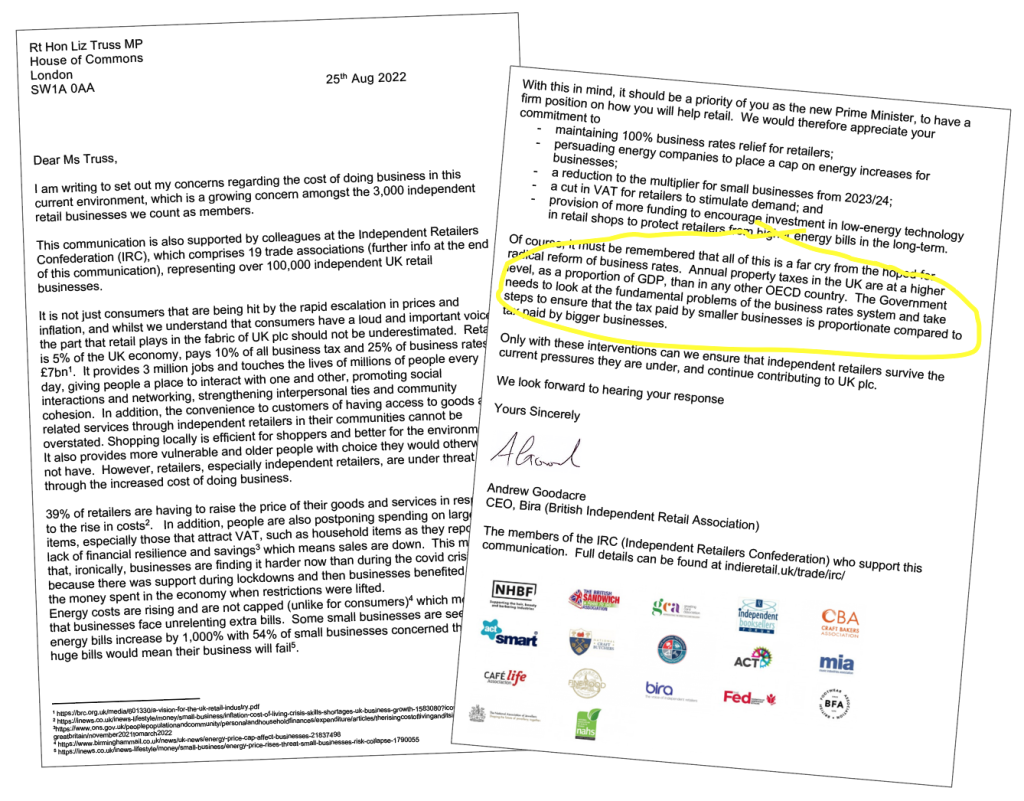

The business rates issue was included in the hard-hitting letter detailing independent retailers’ concerns over energy price hikes which was sent on Sunday, 25 August, to Liz and rival Rishi Sunak on behalf of lobbying platform the Independent Retailers’ Confederation (IRC), of which the GCA is a member.

Signed on the IRC’s behalf by Andrew Goodacre, ceo of the British Independent Retailers’ Association (BIRA), which has long campaigned for business rates reform, the letter called on the Government to maintain the 100% business rates relief for retailers – currently properties with a rateable value of £12,000 or less pay nothing, with the rate of relief gradually going down to 0% as the rateable value rises to £15,000.

However, the system is aimed at businesses with only one premises – a single shop owner pays no rates if the rateable value is under £12,000, but if they have two stores, they have to pay full whack on both unless each site is registered as a separate business.

The letter added: “It must be remembered that all of this is a far cry from the hoped-for radical reform of business rates. Annual property taxes in the UK are at a higher level, as a proportion of GDP, than in any other OECD country. The Government needs to look at the fundamental problems of the business rates system and take steps to ensure that the tax paid by smaller businesses is proportionate compared to tax paid by bigger businesses.”

With 3,000 independent retail businesses as BIRA members, Andrew said: “Retail is 5% of the UK economy, pays 10% of all business tax and 25% of business rates – £7billion. It provides three million jobs and touches the lives of millions of people every day, giving people a place to interact with one and other, promoting social interactions and networking, strengthening interpersonal ties and community cohesion.

Retail Gazette said Liz’s team is understood to be receptive to the idea of expanding business rates relief, with more companies likely to be eligible for support in the North and Midlands than around London.

Craig Beaumont, chief of external affairs at the Federation Of Small Businesses (FSB), said: “We are increasingly confident that business rates are on Liz Truss’ radar. We like that she’s talked about small businesses and self-employed individuals, and the decisions on National Insurance contributions.”

Any help would be welcome as small businesses are facing a cost crisis next month when many corporate energy contracts will come up for renewal with no price cap to protect them from surging wholesale markets. The FSB said businesses have already been hit by a 424% increase in gas costs and a 349% rise in electricity prices since February 2021.

Tory leadership rival Rishi Sunak has also indicated a willingness to help retailers, saying he would extend the current 50% discount on business rates in his first budget, and telling hustings in Darlington earlier in August: “In the autumn we will need to set in place the business rates for the next few years and the top of my mind is always going to be supporting our High Streets and town centres.”

Top: PM hopeful Liz Truss is looking at business rate reform