Card resilience proven as till receipts show Kantar opportunities to grow greeting card sales

It’s strange to think all those shopping receipts people accumulate collectively tell the tale of their shopping habits, how they’re reacting to circumstances, how they’re feeling – and where folk buy cards and how much they pay for them.

At last week’s GCA Conference & AGM, Alex Badini and Ni Wang, from leading research company Kantar, did not gloss over how the challenges the industry is facing are reflected the changes in consumer shopping habits, but they also stressed the positives and how greeting cards are in a much better position than many other product areas.

And they know this thanks to the 106,000 Brits on Kandar’s Worldpanel Plus team who, on a daily basis, photograph the receipts of everything they buy, with the pictures arriving at the company at the rate of one every second.

Alex kicked off their revelations with the bad news at the Nottingham Trent University event last week, rattling off a list of dampeners to consumer spending.

“We have a war in Europe, personal finances are under strain, there’s a new Prime Minister, the death of the Queen and consumer confidence being at the lowest level since the 1960s, not helped by a Government which doesn’t really know what it’s doing,” he told the packed audience – his engaging delivery immediately dismissing any preconceived thoughts that data people are dull.

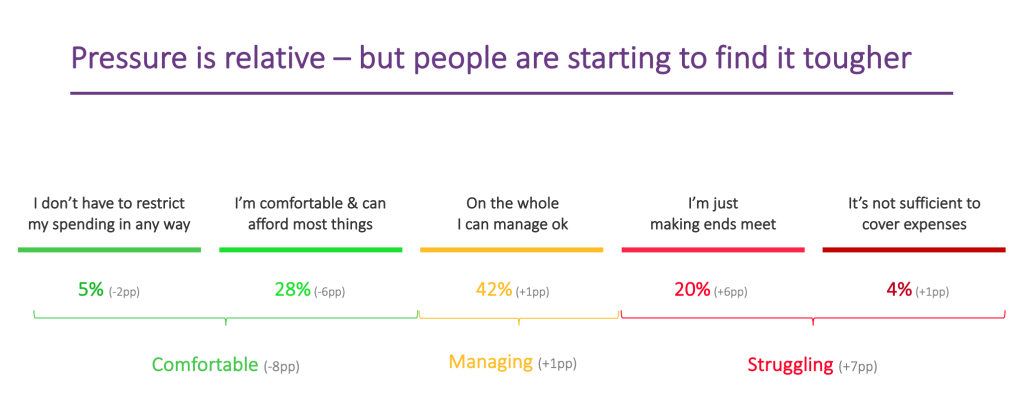

Making a great double act, colleague Ni then explained that, while that pressure on spending is relative, the eight months to July 2022 saw a noticeable 7% increase in those admitting they are struggling, while the group of consumers describing themselves as “comfortable” and not seeing a need to restrict their spending in any way dropped by 8%, a pattern likely to have been amplified further since the data was captured.

This was reinforced by Google Trends’ findings showing a spike in cost-of-living becoming a prominent topic of conversation – they did point out searches for the Love Island TV series also tracked highly.

“In tough times, we still need to find happiness and ways to feel better, and greeting cards are part of that,” assured Alex.

Kantar’s findings show consumer shopping was just 1% up against the stark reality of price rises, while the average price paid per item rose by 9% over the 12 weeks to w/e 7 August, so people have either bought less items, bought less often or shopped cheaper.

Alex explained that, looking at grocery purchases across the board, in the 2007/2008 recession some moved to cheaper own brand alternatives, but premium operators Waitrose and Marks & Spencer also fared well, and this was the start of M&S spearheading the £10 meal deal which, as Alex highlighted: “provided a cheaper way of celebrating.”

This time round Aldi and Lidl have almost quadrupled their market share since 2011, from 4.4% up to the 16% they now command. Though not historically significant greeting card stockists, their growth as part of the wider push by lower-priced retailers should not be underestimated.

The next slide delivered a mighty punch, showing a significant jump in sales for both Card Factory with a 15% rise and Cards Direct up 22% for the three months to w/e 7 August. However, while the upturns are significant, it does not necessarily signal that people are trading down on cards, it could be due to them rebuilding up their card stash in readiness for the full return of children’s parties and the like.

“It is not about going cheap, it is all about conveying value,” said Alex. “You can buy venison in Aldi, and remember in the last recession, Waitrose did well.”

Ni then shared a slide that was uplifting to all present: “There are lots of things people will cut back on to save money before cards,” she said, detailing how takeaways and deliveries followed by eating and drinking out were at the top of the list for doing without to save pennies, while cards and gifts for family and friends came way down in 12th position, well after cutting clothes buying and streaming services subscriptions.

As she reminded everyone, at £1.71 the average cost of a greeting card is far cheaper than a bottle of wine, bunch of flowers or cup of coffee. The GCA Annual Market Report has an average card price of £1.97 which is slightly higher because Kantar can only gather information from receipts where there is an EPOS system so sales from many indie retailers don’t get recorded.

“Some things are worth more than the cost,” reinforced Alex, citing cards as one of them, “the flowers will die and the wine will be drunk, but you still have the card.” Alex added that, as long as the designs remain relevant to the buying consumer, their purchases are highly likely to be less negatively affected than other product areas during this cost-of-living crunch, especially given how engrained they are in the British psyche.

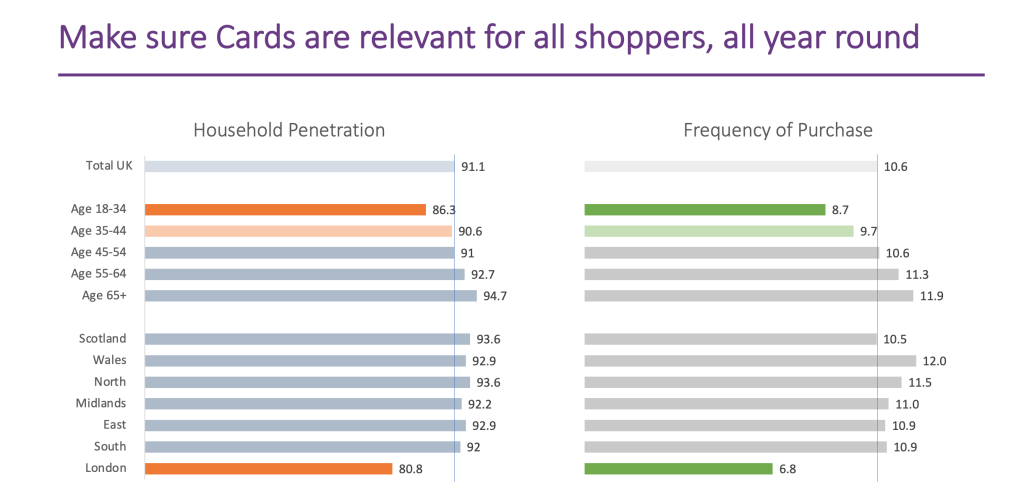

“Nine out of 10 households buy greeting cards, and they buy them nearly every month,” reassured Alex, sharing a slide which showed the pattern of card buying up the age scale.

“As we get older, we buy more,” he stated though, encouragingly, there’s only a 9% difference between 18 to 24 year olds, the group with the lowest card penetration at 86.3%, and those buying the most cards – 94.7% in the 65-plus age group.

“In a tough climate there is still light,” said Alex, delivering a positive message about the greeting card sector’s place in the consumer’s shopping basket as well as their heart, and he added there are still enclaves of opportunity.

“In London, only eight out of 10 households buy cards, and those that do, only seven times a year, a lot lower percentages than the UK average. Those living in London come from a wide range of cultures, could it be that the cards available do not reflect these?” he questioned.

Having been tracking consumer sales of greeting cards for Kantar since April, the industry has clearly got under Alex’s skin: “Greeting cards do a lot of good. They encourage literacy and uplift people, for starters. So, dial up the value, continue to make the designs relevant and make the most of the London opportunity.”

Top: Kantar’s Alex Bandini and Ni Wang address the GCA event