Retail commentator Michael Weedon, managing director of Exp2, summarises an insightful presentation he gave at the recent London Stationery Show on the High Street.

This year has produced a flood of shocking news headlines featuring household name retailers, with administrations at Toys’R’Us, Maplin and MultiYork, widespread store closures by New Look, Carpetright and Moss Bros, and contractions announced in the estates of House of Fraser, Debenhams and Marks & Spencer. Adding to the bad news from product retailers has come a slew of announcements of further branch closures by several big banks. More than 20,000 jobs are estimated to be in danger within just this group. So, is it game over for the High Street?

A more relevant question is whether this is actually different from any other spring.

Human beings are attuned to threats in our environment. We find it easier to identify what might be trends with well-known fascias than we do when we think about a large numbers of small things, like independent shops. It doesn’t help that the big picture is not readily available to most of us anyway. Either way, we find it difficult to see the context within which these headline events occur. But context is key.

For a start, there are about half a million retail units in Britain. That number covers non-food outlets (including of course greeting card and gift shops), food stores, leisure operations (which includes coffee shops) and service units, such as barbers and banks. Each year roughly one in ten of the businesses in these areas shuts up shop. Almost all of those are replaced with a quickly bright, optimistic new outfit.

Half a million of anything is a difficult number to visualise. If one person from every shop was given a ticket to Wembley Stadium you would need five and a half Wembleys to seat them. Not helpful? OK, if you gave a ticket for one person to each of the shops that closed in 2017 and one to each that opened they wouldn’t quite fit in to one Wembley. The thing to bear in mind is that huge changes occur every year and what makes the difference to the high street is the gap between openings and closures. In 2017, about 5,000 shops closed which is only slightly more (1%) than the shops that opened.

This closeness in the opening/closing relations has paused the long-term downward trend in shop vacancy. In 2011, when we had 14.6% of shops empty – equating to an astonishing one in seven shops – the government was panicked into action, appointing Mary Portas to report on solutions to the problem of “the failing high street”. The latest figures from the Local Data Company suggest that after several years of improvement, roughly one in nine units remains shuttered – one in eight retail outlets and one in 12 leisure units. Whether this pause is the prelude to further falls or the beginning of a new upswing remains to be seen.

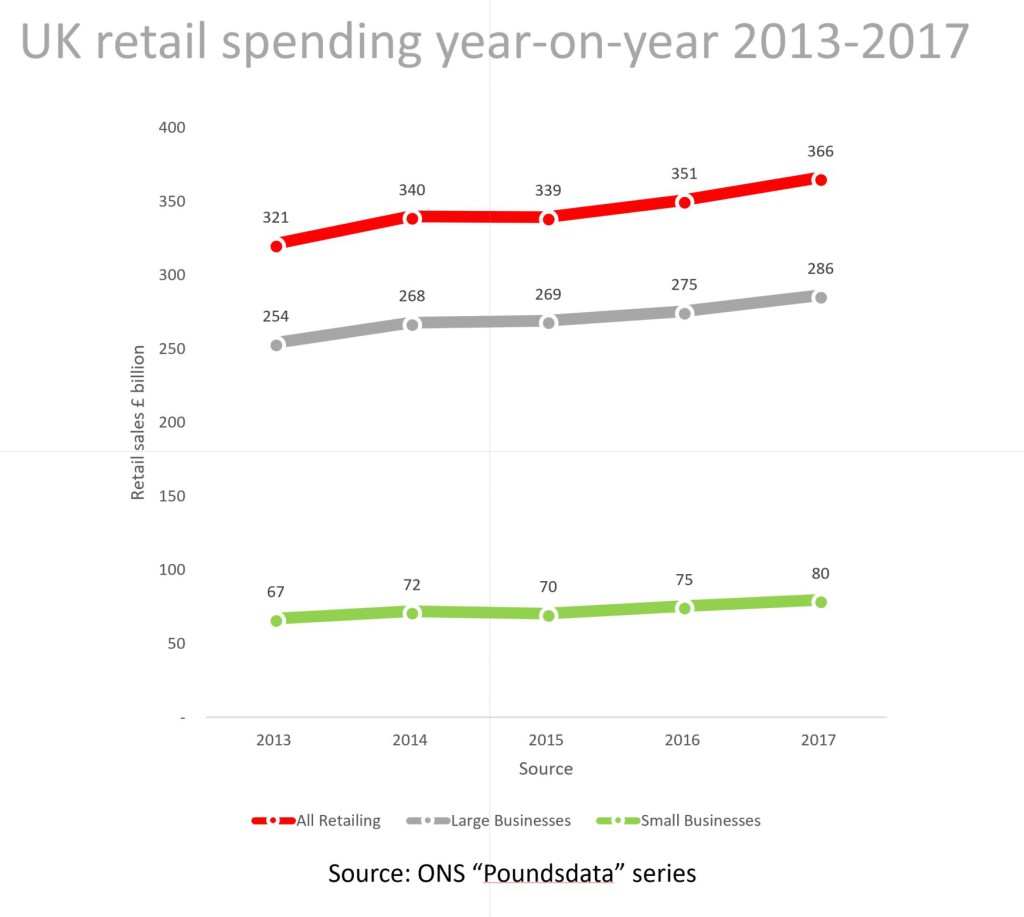

So, is this about retail turnover? Not according to the ONS, which publishes a fascinating series of figures for sales. Its normal monthly retail sales release actually talks about retail volume (how many things sold), but most of the retailers I know (and I know a great many) just talk about what’s in the till. Last year we, the Great British Public, spent just over £365 billion with retailers. That’s a neat billion quid a day. Just under £8 in every £10 that we spent went to large retailers and the rest to small businesses. So, last year we spent £80,000,000,000 between us with small shops.

We may be spending more money, but we are also spending it, and our time, differently. Looking back over the cumulative footfall figures measured by research tracker Springboard and the British Retail Consortium (BRC) it seems that retail footfall has dropped by more than 5% since 2011, with high streets and shopping centres registering 10% fewer footsteps and retail parks gaining more than 5%. To put that another way, retail parks have been keeping pace with population growth while the others have fallen behind. No surprise then that Card Factory, Cardzone and Paperchase are among those to have beat a path to retail parks in the last few years.

However, town centres do still house more than half of all the shops in Britain. Retail parks only provide homes for one in 40. However, the units on retail parks have 13 times the selling space of the average trading unit defined by the government’s Valuation Office Agency (VOA) as a shop. Looking at the floorspace for these units in the 2017 rates revaluation list it looks like retail parks actually account for more like a quarter of retail selling space, in England and Wales. They were the only location type to show a net gain of shops in 2017.

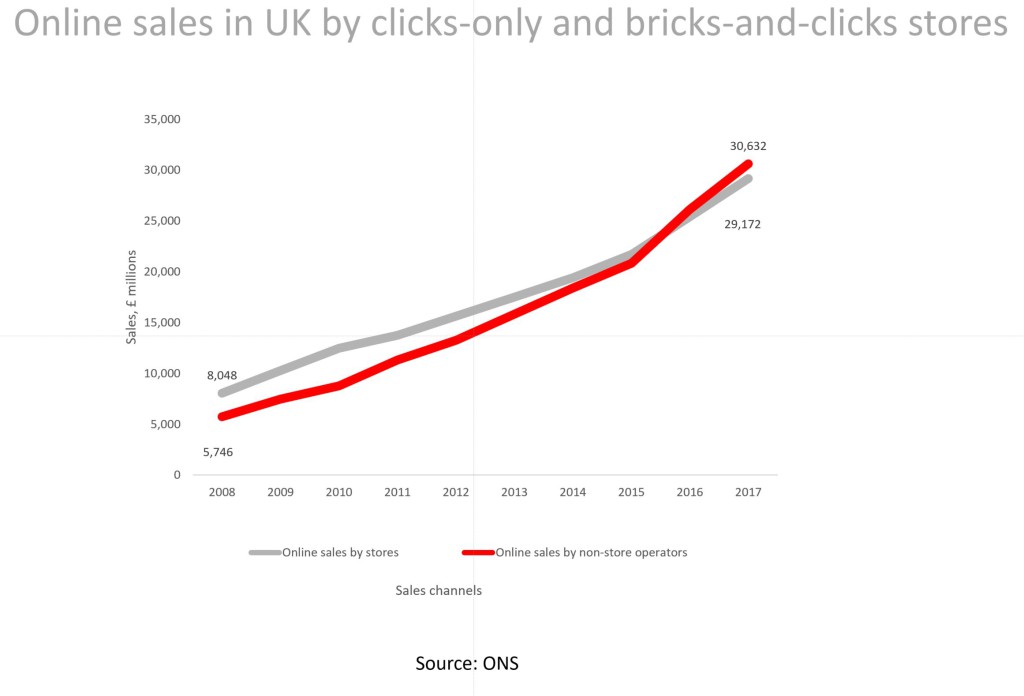

Attention on the growth of retail parks has been scant in comparison to the scrutiny given to online sales. Online sellers are good at selling products, not quite so good yet at vending food and fairly poor at selling services delivered in person. In the past five years the number of non-food goods shops have dropped by nearly 6,000, while food, leisure and service ‘shops’ have more than made up for this number.

Now the percentage of greeting cards bought online is not as high as other product sectors, but it is growing, with high street names like Paperchase and Scribbler both admitting that they have been taken by the surprise of online sales. The grocers, although they do offer cards as part of their line-up, have not really got to grips of the potential there.

Service and leisure in particular have been replacing non-food retailers since the crash. While banks have been pulling down the shutters year after year, barbers, for example, have been opening their doors in increasing numbers. Anything which gives the consumer a reason to be in a particular place rather than being able to carry out transactions purely on their smartphones, gives the retailer a reason to provide a place for them to be. Services such as personalisation, as evidenced in stationery and card retailer Kikki.K and Paperchase’s flagships, fit right in. And smart retailers can make that work for them both online and in person.

Whether it’s choice of a particular type of location, a key type of service or an addictive media type, the key thing for the high street of the future will be the same thing that made the high street of the past so important – it will need to be right at the centre of consumers’ attention.

Read the full article in the June issue of Progressive Greetings magazine.