Experiences gift business blamed for £33m loss for online greetings retailer

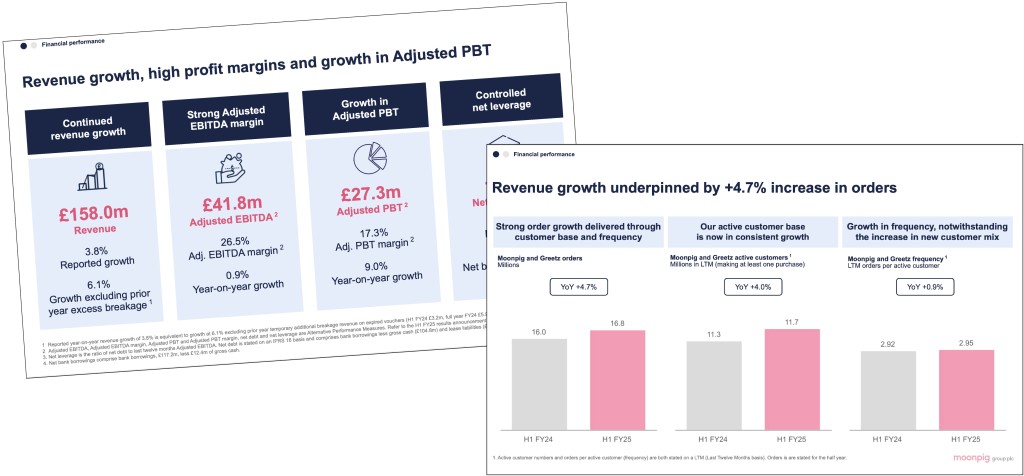

Double-digit growth at Moonpig has underpinned a 3.8% revenue increase at the group to £158 million with continued technology innovation including artificial intelligence credited for the rise.

However, the online card and gift retailer had to report a £33m loss overall in the half-year results to 31 October, 2024, after writing down the value of the Experiences gift business it bought for £124m in 2022.

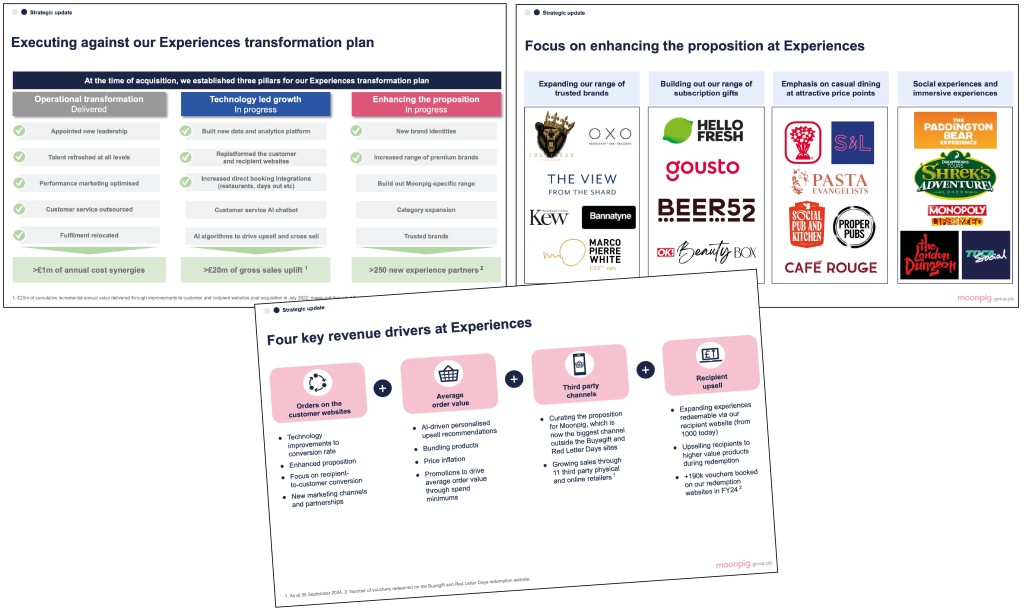

In the presentation yesterday, 10 December, the company warned it now expected a “longer timeline for aligning Experiences revenue growth with its full potential” and wrote down the value of the business by £56.7m.

But on the core greeting card side there was good news with active subscriptions to Moonpig and sister Netherlands-based online platform Greetz Plus having surpassed expectations to hit 750k members from 200,000 a year prior, while the database of customer occasion reminders grew to 96million from 82m.

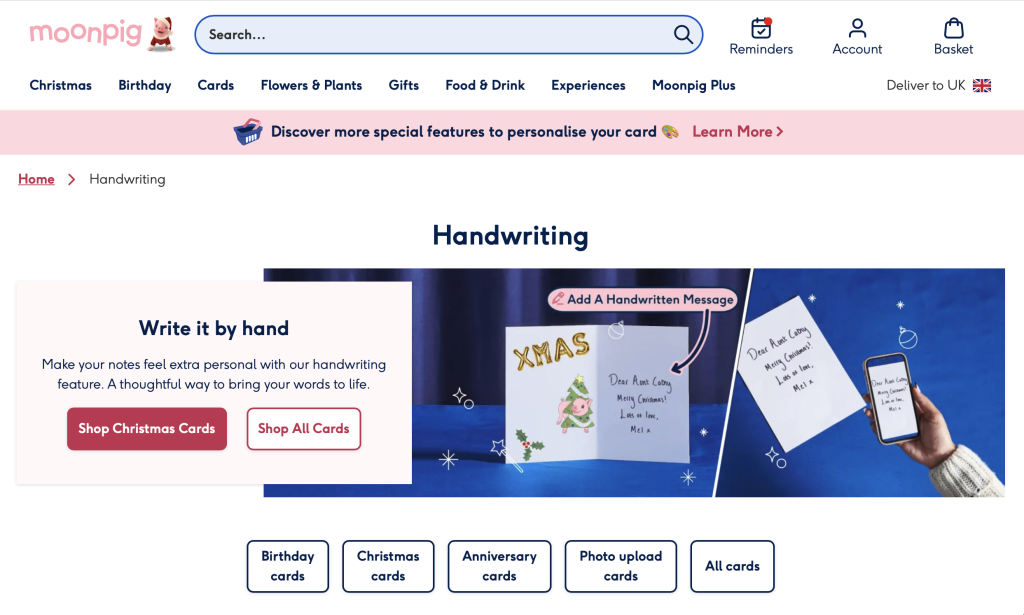

CEO Nickyl Raithatha praised the AI moves: “Ahead of Christmas, we’re excited to have launched Your Personalised Handwriting, an AI-driven feature that allows customers to add their own handwriting to our cards.

“By creating their handwriting as a font saved to their Moonpig account, customers can type a message and see their handwriting seamlessly appear within the card. This launch is a key step in our roadmap of innovative features, leveraging emerging AI technologies to enhance the card-giving experience.”

Nickyl said he is “pleased to report continued growth in revenue” and added: “Moonpig’s performance “underpinned by robust growth in order volumes, powered by our multi-year investments in technology and innovation and the structural market shift to online. Raising our medium-term profit margin target demonstrates our confidence in the outlook for the business.

“We continue to innovate to attract and retain our loyal customers. To date, over 17m innovative card creativity features have been used to customise our cards, including audio and video messages, AI-generated text suggestions, stickers, flexible photos and digital gifting solutions.”

The presentation released first thing yesterday was followed by a webcast briefing for analysts and investors with Nickyl and chief financial officer Andy MacKinnon where they explained the 10% increase in the Moonpig brand revenue was underpinned by growth in orders, offsetting the Greetz revenue decrease, which had dropped from -5.3% in the second half of the 2024 full year, to -4.0% in the first half of the 2025 full year.

Between the two, total orders grew by 4.7% with an average order value rising by 2.5% – and revenue in the US, Australia and Ireland has grown at a combined 42.5% year-on-year.

Gross profit hit £93.6m, up 5.1%m on the previous year’s figure of £89m, while adjusted earnings before interest, taxes, depreciation and amortisation (EBITDA) edged up to £41.8m from £41.4m, and adjusted EBITDA stood at 26.5%.

But Moonpig reported a loss before tax of £33.3m, a decline from a profit of £18.9m a year ago, due to a £56.7m non-cash impairment charge in its Experiences division, as adjusted profit before tax rose by 9.0% to £27.3m, driven by growth in trading and lower interest costs.

The strong cash generation has enabled dividends, with the company revealing today that it will pay an interim dividend of 1.0p per share in the spring, and the share buyback programme of up to £25m is ongoing through the second half of the financial year.

While the core greeting card side is strong, the update said the company is continuing executing its transformation plan for the Experiences arm and added: “Trading conditions remain difficult. In the context of the challenging macroeconomic environment, we now expect a longer timeline for fully realising the revenue growth potential of Experiences. This is reflected in the £56.7m non-cash charge for the impairment of Experiences goodwill at 31 October, 2024, classified as an Adjusting Item.”

On the outlook, the group said: “Current trading remains in line with our expectations. Growth has been underpinned by consistent strong sales and orders at Moonpig and is supported by steady progression at Greetz.

“Given ongoing macro headwinds in gifting, trading remains challenging at Experiences and we remain focused on delivering our transformation plan. Accordingly, our expectations for full year revenue remain unchanged.

“Our business is well positioned to deliver sustained growth in revenue, profit and free cash flow, driven by our continued focus on data and technology.”