Private equity firm raises £40m as online greeting card retailer endures worst day of share trading

Significant stakes being sold by private equity backers at Moonpig have sent shares down at the online greeting card retail giant in its worst day of trading in three years as a London Stock Exchange-listed company.

The Times newspaper reported that the trading on Thursday, 25 April, saw investors led by private equity firm Exponent – which originally bought the business in 2015 – sell 25million shares in the FTSE 250 business at 160p each – more than 10% below the previous day’s closing price of 178p,

And the move meant Simon Davidson, Exponent’s nominee director resigned from Moonpig because his company’s shareholding had fallen below 10% of the card giant’s issued share capital, now cut by around a third to 8.2%

Kate Swann, chair of the Moonpig’s board, said: “On behalf of the board I would like to thank Simon for the significant contribution that he has made to Moonpig Group across the last eight years. His insight and expertise have been of great value to the board.”

The deal raised around £40million for Exponent, at a time when larger investors have been reducing their stakes In Moonpig since its £1.2billion stock market listing in 2021 when shares were offered at 350p which had earned the private equity firm £491m for selling 41% of the business.

Shares rose to a peak of 488.5p in June 2021 but have been on a steady decline since – as have the values at other companies such as Deliveroo and Dr Martens which had high-profile floats around the same time.

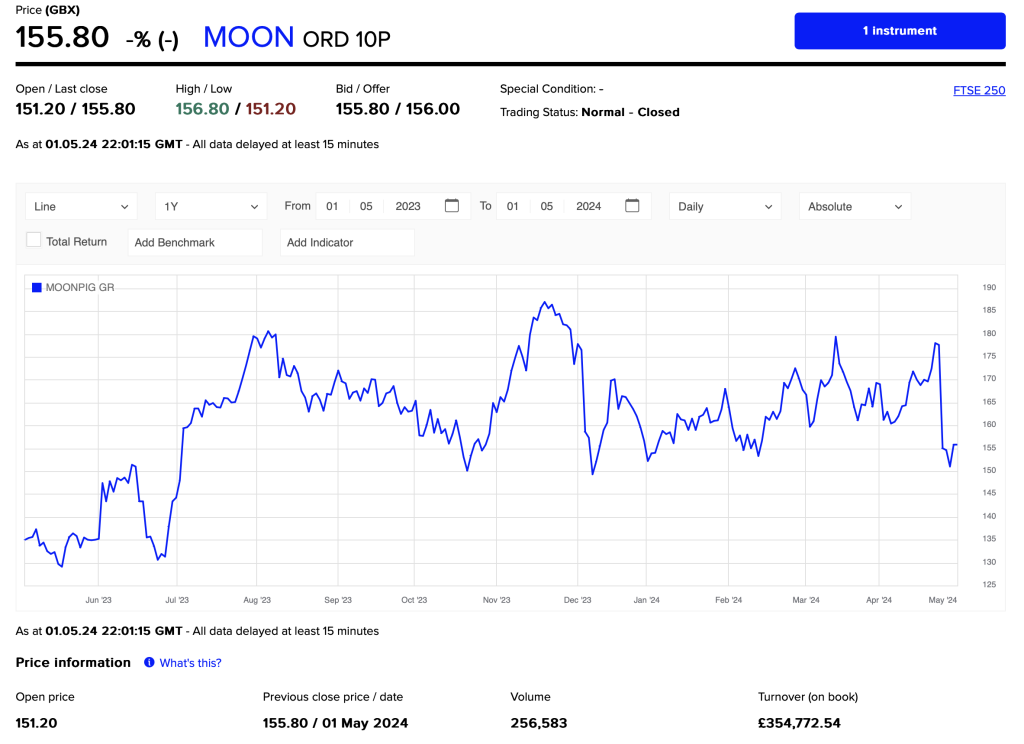

Following a low of around 130p in June and July 2023, there was a high of 186p in November, then it fell to 150p before rising again to 180p in March but, after the significant share sales on Thursday it closed at 155p, dropped again on Friday and Monday to 151.2p before closing slightly up yesterday, at 155.8p.

In December, Moonpig announced its half-year results to 31 October saw an uplift in both sales and profits with revenue climbing 6.5% to £152.1million, and adjusted pre-tax profits rising to £20.8m.

CEO Nickyl Raithatha said at the time: “We are pleased to report year-on-year growth in both revenue and profit despite the challenging macro-economic environment, marking the group’s return to revenue growth.

“We continue to innovate to attract and retain our loyal customers. As the clear online leader in greetings cards, we remain well positioned to benefit from the long-term structural market shift to online.”

Nickyl has been ceo since June 2018, with the business founded over 20 years ago by Nick Jenkins who sold it to Photobox in 2011 for £120m, then Exponent bought the group in 2015.

The Moonpig group, which includes Dutch online greetings retailer Greetz, Buyagift and Red Letter Days, will announce its full-year results for the 12 months to 30 April, 2024, on 27 June.