Exclusive PG Retail Barometer reveals indies have fared pretty well

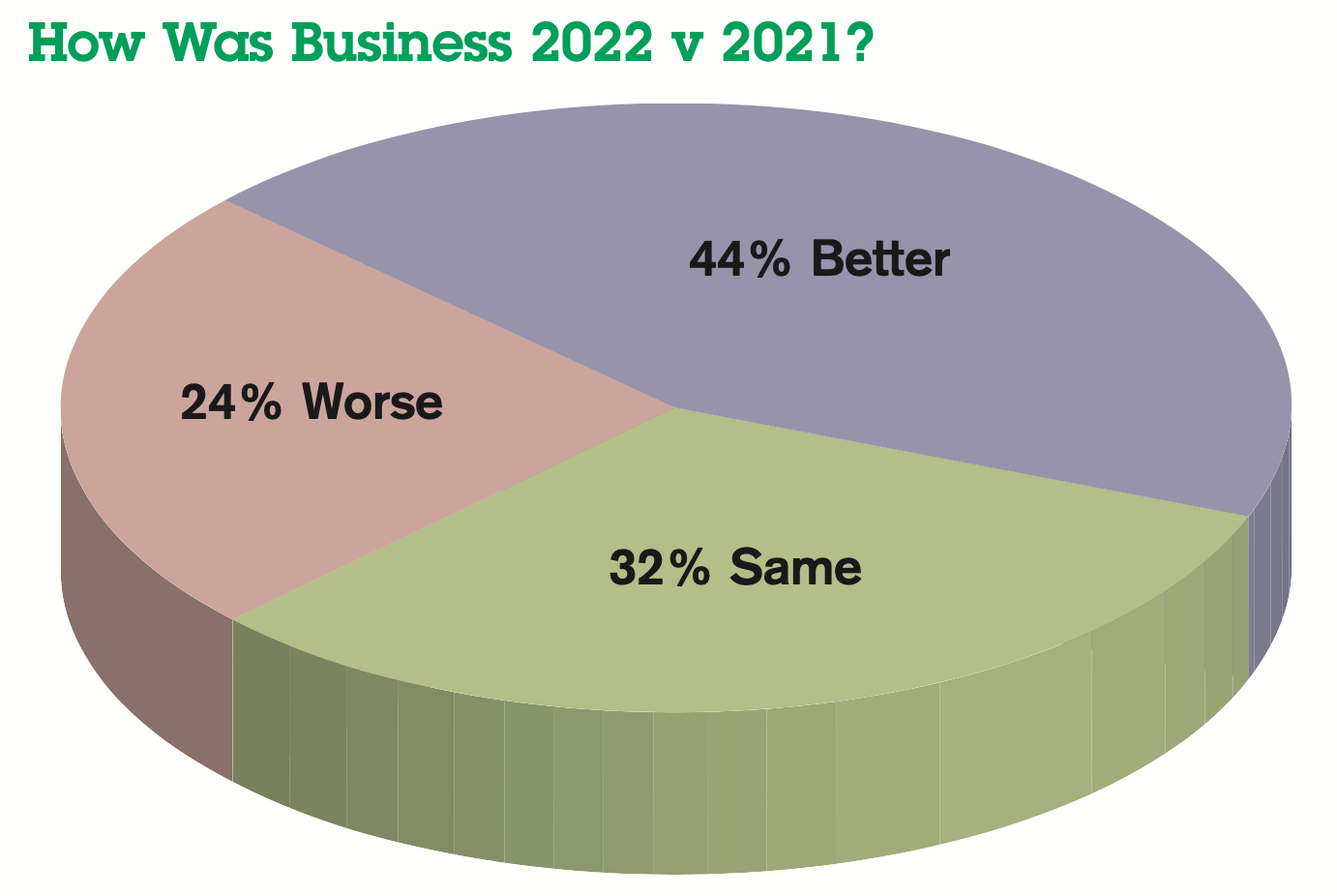

Despite the challenges of the cost-of-living increases along with both rail and postal strikes, independent greeting card retailers fared pretty in 2022’s rollercoaster ride, with two thirds having experienced growth or at least remained on a par with 2021 levels.

And, after an erratic few years, the picture of the new normal is starting to appear thanks to the findings of the annual PG Retail Barometer, where the overall results are a lot more encouraging that in many years past, if not quite as positive as 12 months ago where everyone was looking forward to a busy 2022 – then Russia invaded Ukraine!

With retailers now back on the rollercoaster for the 2023 ride, PG Buzz has analysed the responses to the yearly survey into the health and wealth of independent greeting card retailers to find out how they reflect the ups and the downs.

This latest survey invited 1,750 independent retailers to participate with all responses completed by 6 January, 2023.

“Greeting cards continued to hold their own as a very relevant and tangible way of communicating with loved ones,” commented Jakki Brown, MD of Max Publishing which undertakes this annual survey. “A third of respondents believe the consumer’s appreciation of cards grew over the last year, having really come into their own during the lockdown years.

“This is fabulous news for the industry and shows that the GCA’s Send A Card, Deliver A Smile mantra is really hitting home and proving the personal touch still matters in the digital age,”

Almost half of indies who responded saw their business grow, albeit marginally, while a third held the line on the year previous that had been a bumper one for many, and around a quarter experienced a slide in sales,

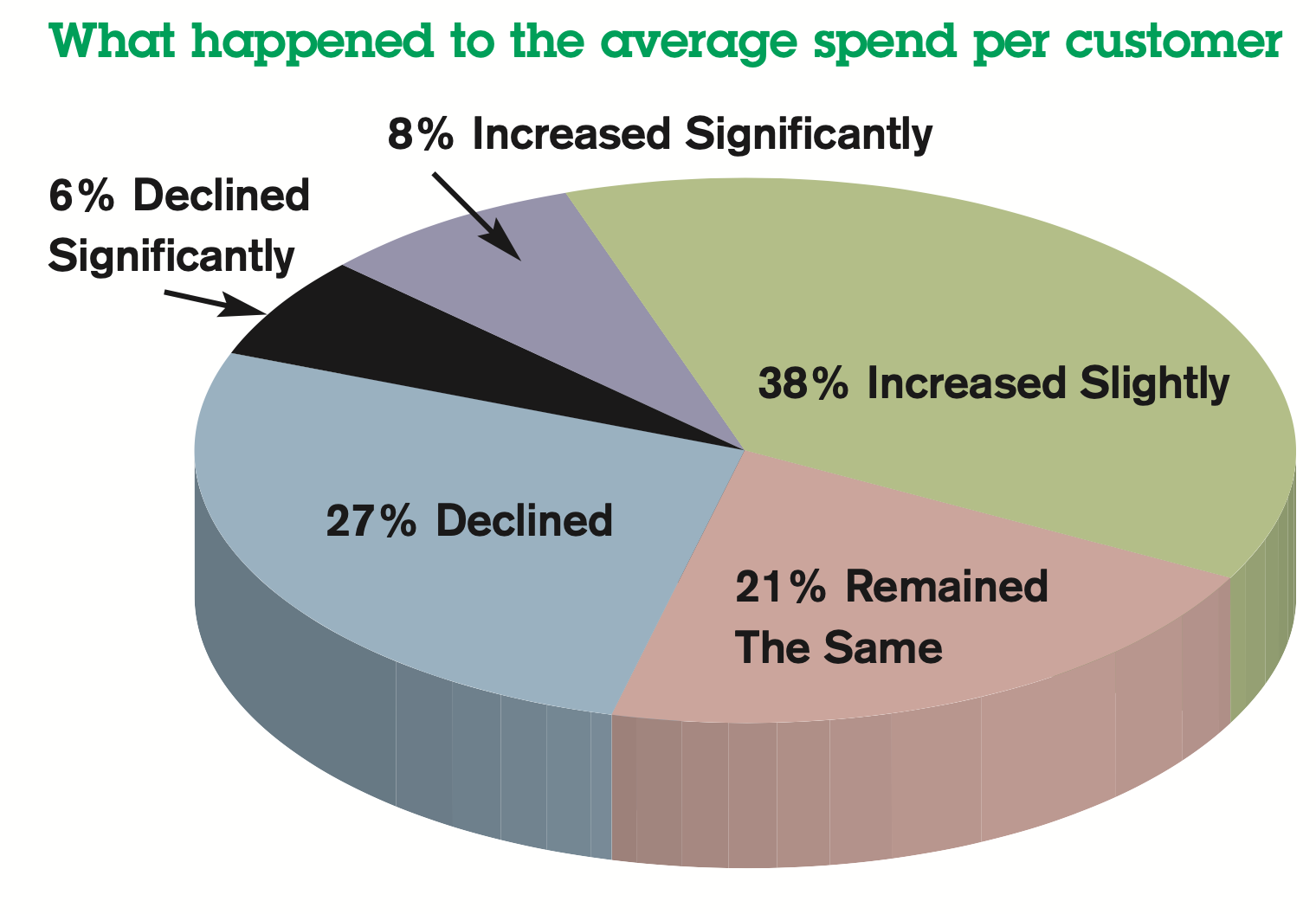

The average spend per customer may not have reached the heights of 2021 where lockdowns saw more concentrated spending, but it was on the up for 46% of respondents – 8% said it had increased significantly – though sadly a third experienced a drop.

And in a hat trick of business boons, the shop local drive continues to serve indies well, with the trend cited as having been the biggest help to trade in the last 12 months by 64% of respondents.

Of course, downsides become apparent in any survey and the all-encompassing cost-of-living crisis came straight into the list as the top reason indies cited as having had a detrimental effect on their business over 2022, though the Covid hangover was still among the top banes, dropping from first to third, as were supply issues which went down two places to fourth and, with people able to get back to shopping in person again, the old chestnut of parking issues climbed back up to fifth place from 10th, while the bugbear of charity shops selling cards rose to seventh from joint 11th.

While the postal strikes do feature as having made a dent on trade, as the survey covers the whole year and the CWU action started in early December, this upheaval on sneaks in at 14th place, not as high up the list as might have been expected.

Supermarkets continue to be a thorn in the side of indies, their improved displays and convenience still being a sizeable niggle although dropping from fourth to sixth spot, while the growing number of empty shop units climbs from 13th to 10th place showing it’s a greater dampener on trade than a year ago.

Meanwhile, indies have started 2023 with a feeling of cautious optimism – 35% have gone into the new year aiming for growth, although only 4% had said they’re gung ho enough to be expecting significant growth.

However, pragmatic realism is a strength and there cannot be many sectors who are starting this period of uncertainty with over three quarters (76%) expecting to grow or hold steady.

Looking further ahead to the next 10 years, there has been a little softening of sentiment, with 42% of respondents feeling positive about the role of the independent card retailer a decade hence, compared to 65% in the last survey, while 17% see the long-term future as weak – three years ago this figure was 30%.

The full story of the 2022 PG Retail Barometer – which also covers Threats & Opportunities, Growth Indicators, 2022 Christmas Sending, Sourcing Matters and Sustainability Drivers – can be found in the February issue of Progressive Greetings magazine, and PG Buzz will feature further outtakes over the next few mailings.

Top: The PG Retail Barometer reflects indies’ views