16,000 jobs at risk after struggling retail chain reveals shares suspension over ongoing debt talks

Speculation is rife that struggling convenience store chain McColl’s is on the brink of collapse after retail industry sources told Sky News yesterday (5 May) some form of insolvency proceedings is now more likely than not.

McColl’s, whose 1,100+ estate of managed stores and newsagents all sell a wide range of greeting cards among the foodstuffs and essential items, had said on Tuesday (3 May) that shares in the business were set to be suspended from trading on the London Stock Exchange as it confirmed it is not able to publish its annual report by the end of May 2022.

The company announcement said it has delayed releasing the full year 2021 results and report for the 12 months ending 28 November, 2021, because it would be unable to get its accounts signed off by auditors in time.

However, yesterday Sky News reported it has learned McColl’s, which has an extensive national partnership with Morrisons for rebranding stores as Morrisons Daily, could call in administrators as early as today (Friday, May 6) putting the jobs of its 16,000 staff at risk.

Sky said the company’s imminent collapse is expected to spark renewed interest in a partial takeover from both Morrisons and EG Group, the petrol retailing giant owned by TDR Capital and the billionaire brothers Mohsin and Zuber Issa.

Sky’s sources said the situation remained fluid but a collapse into some form of insolvency proceedings was now more likely than not. One cautioned, however, that a rescue deal remains possible and ongoing talks about McColl’s future could mean the appointment of administrators was delayed beyond the end of this week.

There has been no official comment from McColl’s on this speculation but on Tuesday the retailer’s statement regarding the shares suspension said: “The delay reflects the need for a conclusion to discussions with key stakeholders around a potential financing solution for the business, in order to finalise the company’s FY21 audited financial statements. As these discussions remain ongoing, the board has concluded there is now insufficient time in order to meet the current deadline for filing these results under the Listing Rules.”

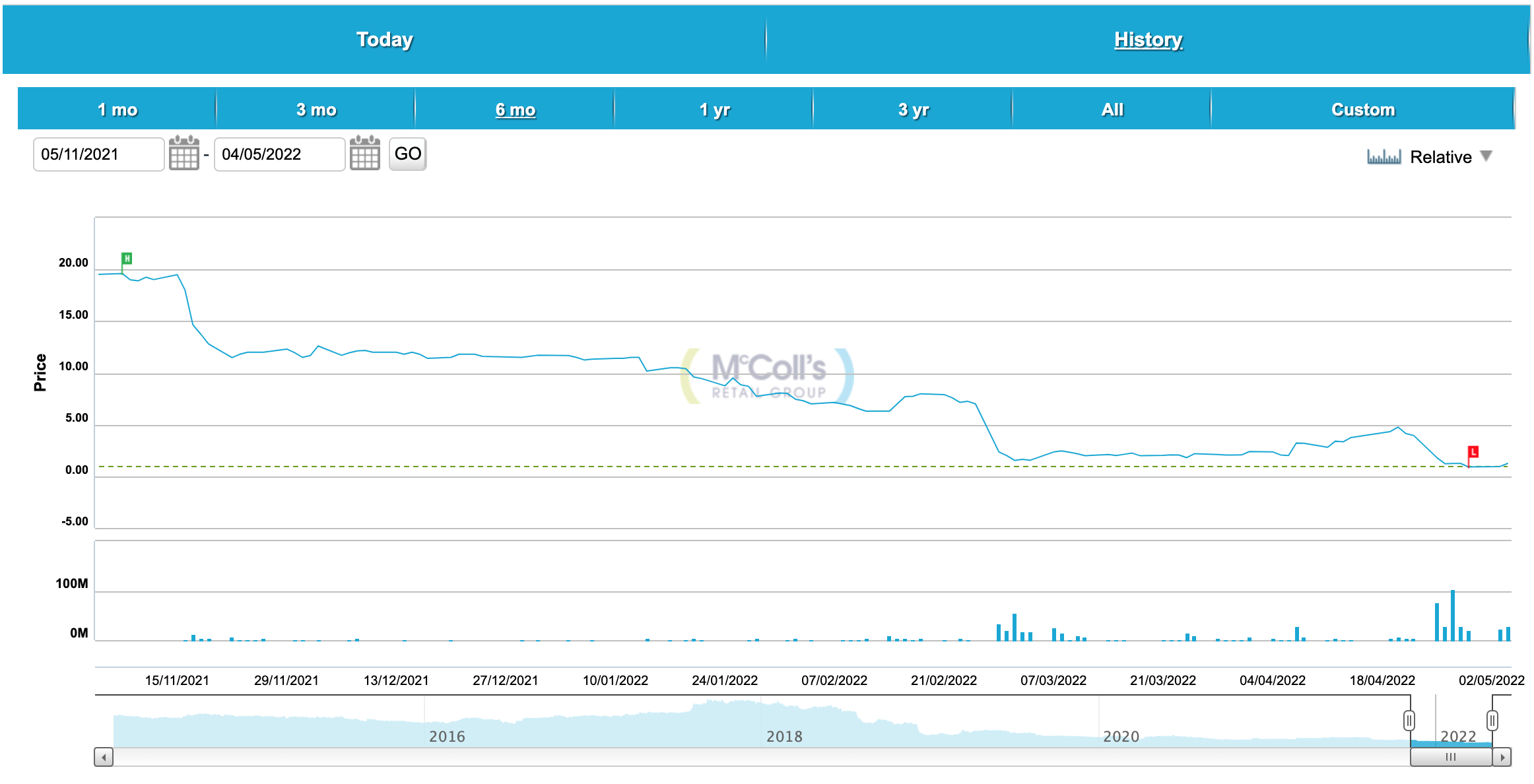

Shares in the business plunged from 20p in November to 1.5p in February amid fears the group might collapse due to debts of around £170million but in early April the price unexpectedly rose by 71% to 3.4p before settling to hover around 1p. McColl’s expects the Stock Exchange listing of the company’s ordinary shares of 1p each be temporarily suspended with effect from 7.30am on 1 June, 2022.

The group, set up in Glasgow in 1901, said it remains in ongoing dialogue with its lenders with a view to achieving a longer-term agreement in relation to the balance of its existing facility but it admits there is no certainty as to the successful outcome of these discussions.

In March chief executive Jonathan Miller left his role and the McColl’s board after 30 years with the company, although he keeps his shareholdings, and chief operating officer Karen Bird became interim chief executive.

With 16,000 staff, roughly 6,000 on a full-time equivalent basis, the sheer size of the operation – which covers McColl’s, Martin’s newsagents, and RS McColl’s in Scotland – makes the group a large card retailer, and it has a partnership with supermarket Morrisons for a Morrisons Daily store rollout planned to hit 450 conversions in total, with 200 already in operation.

McColl’s had also released a statement last week (25 April) saying the group had experienced mixed trading since February, flagging that “while a recovery in trading performance had continued during the first half of March, the business has since experienced softer trading through the Easter period impacted by reduced consumer spending and continued supply chain disruption across the industry”.

However, the group’s Morrisons Daily stores – 69 have been opened in FY22 so far – are performing strongly, delivering like-for-like sales growth that is at least 20% better than non-converted, comparable stores, and ahead of the total convenience market.

The company said: “The move to convert stores to the Morrisons Daily format is fundamentally reshaping the business into a more profitable and sustainable model in the medium term.”

Top: With 1,100+ stores McColl’s is a large greeting card retailer