Greetings retailers worry over reports – but inflationary increase not yet confirmed by government

Fears that business rates will rise sharply are worrying greeting card retailers – although there are also concerns that the reports are simply scaremongering.

A recent article in The Times included a report claiming that inflation will trigger a £2billion rise in business rates as the tax is due to be recalculated in April using the government’s multiplier that’s usually pegged to September’s rate of consumer price inflation (cpi).

As cpi was confirmed on Thursday, 19 October, at 6.7%, The Times said analysts at investment management and property company Colliers International and property intelligence firm Altus Group forecast the property tax will rise from £26bn to between £27.7bn and £27.95bn.

British Independent Retailers’ Association ceo Andrew Goodacre told PG Buzz: “BIRA is really concerned about any potential increase in business rates next year. The multiplier is due to go up by inflation and we believe this must be frozen. More importantly we want to see the current retail discount retained at 75% – this is so important to the survival of many indie retailers.

“The government’s Autumn Statement is in November and we have already submitted our ideas to Treasury and also written to the chancellor ahead of this important announcement.

“In the current economic climate with depressed sales, independent retailers cannot afford more increases in the cost of doing business.”

As a property tax based on the rateable value of business premises, retailers in prime High Street locations are disproportionately affected – and the small business rate relief programme only kicks in for those who operate from a single premises with a rateable value under £15,000 or where the total rateable value on all other properties is under £20,000, or £28,000 in London.

The level has been held at 51.2p for every pound in rateable value since the pandemic struck in April 2020 closing all but essential retailers, but will rise 6.7% to 54.6p in the pound if the multiplier is reinstated next year.

The current cost-of-living crisis has been causing issues among greeting card retailers with Wilko closing all 400-plus stores, Clintons axing 38 outlets as part of a court-approved restructuring deal, along with Paperchase’s spectacular collapse, with the cost of business rates cited as part of the problem.

The British Retail Consortium has calculated the sector would face paying an extra £470million in tax, and chief executive Helen Dickinson told The Times: “This will inevitably put renewed pressure on consumer prices. As a result, retailers are publicly calling on the chancellor to freeze the business rates multiplier, allowing them to keep driving down prices, and invest in new shops and jobs.”

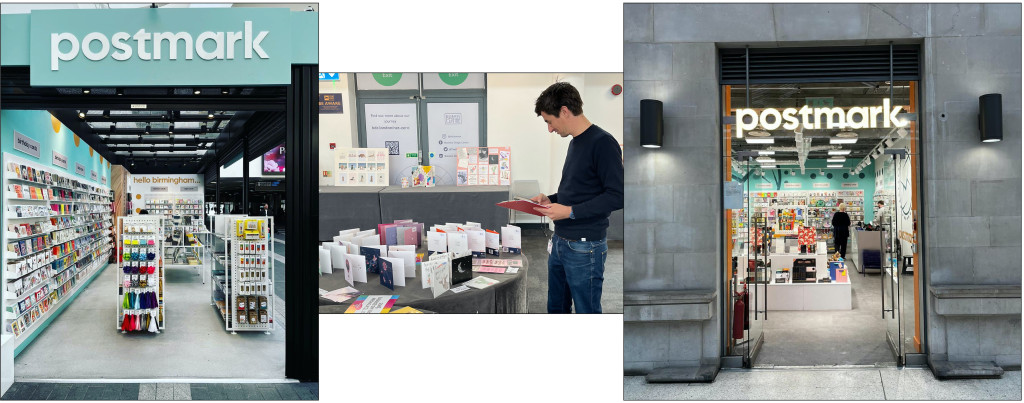

At Postmark, which recently expanded from seven stores in London to 15 including in Birmingham and Glasgow, co-owner and md Mark Janson-Smith said: “This is potentially going to be crippling for so many retailers when we’re all fending off so many difficulties on so many fronts.

“I generally worry for the industry as prices are rising at such an incredible rate, I fear consumers will soon start to question what was once such an impulse purchase.

“We’re already receiving lots of notifications of price increases from suppliers for 2024 and, after last year’s large rises, I can see the average price of a card soon being £3.50-£4 which will have huge implications. This proposed rates rise along with another rise in the minimum wage will put incredible pressures on many businesses across the country.”

Saying he is “incredibly grateful’ for the government’s support for retailers over the past few years, Mark believes the whole system of how businesses are rated is “out of date and in desperate need of modernisation”, and he added: “The gap between what bricks and mortar stores and online operators pay, needs to be bridged.”

At Set in Leicester, owner Stuart Delahoy admitted: “Small business rates are definitely a problem. Our rateable value is £51,500 for our shop and, until the rate relief during Covid, we were paying £27,000-28,000 a year.

“We still get some help post-Covid which is enormously helpful, but the government needs to recognise that the small business rate relief limits are unfavourably low – you’d have to have such a small shop in in city centre to be under £15,000, and it was the same problem with the business help during the pandemic as we were in the same class as John Lewis for our 1,000sq ft High Street store.”

Adding that the “outdated business tax” isn’t fit for purpose, Stuart acknowledged the difficulty is in how to replace the funding for local government, but believes there should be more tiers in the rate relief system to help smaller retailers who currently don’t qualify.

Praising suppliers who have shouldered some of the recent increased costs in manufacturing and distribution, Stuart pointed out that retailers’ margins are static with rises in minimum wage and utilities cutting into profits unless turnover can be goes up.

He added: “I don’t honestly know if the rates relief we’re currently getting will continue, I only know that the rates bill this year was about a third of what we were expecting so I just kept my head down. We have had help here in Leicester because of the situation with our own individual lockdown, but I don’t know how long that will last.

“The way the business rates relief system works at the moment does penalise you if you try to expand from one small store to two, you’d lose your relief. It definitely discourages business expansion.”

However, Miles Robinson, co-owner of the House of Cards small retail chain with seven stores in the Home Counties, all of which fall outside the brief for small business rates relief, feels it may be a “scaremongering” story.

“No such increase has been announced by the Treasury,” Miles explained, “and, although the business rate multiplier has in the past followed the inflation level in September, it hasn’t done for a while.

“The government also hasn’t announced what, if any, retail relief will be granted and I’m pretty sure there will be something. Small business rate relief doesn’t apply to us as we don’t have any properties under the £15k cap and this may be one area that gets changed.”