Closing down sales see scramble for store acquisitions

As the aftermath of Tesco’s takeover of the Paperchase brand kicks in, the retailer’s stores around the country are in the midst of closing-down sales, with all 100+ standalone shops and concessions preparing to shut.

PG Buzz understands there will now be a scramble for the stores with the five Network Rail outlets – in Victoria Station, London Bridge, Waterloo, Kings Cross and Birmingham New Street – known to be up for tender, and some of the players in the greeting card industry have made their interest clear.

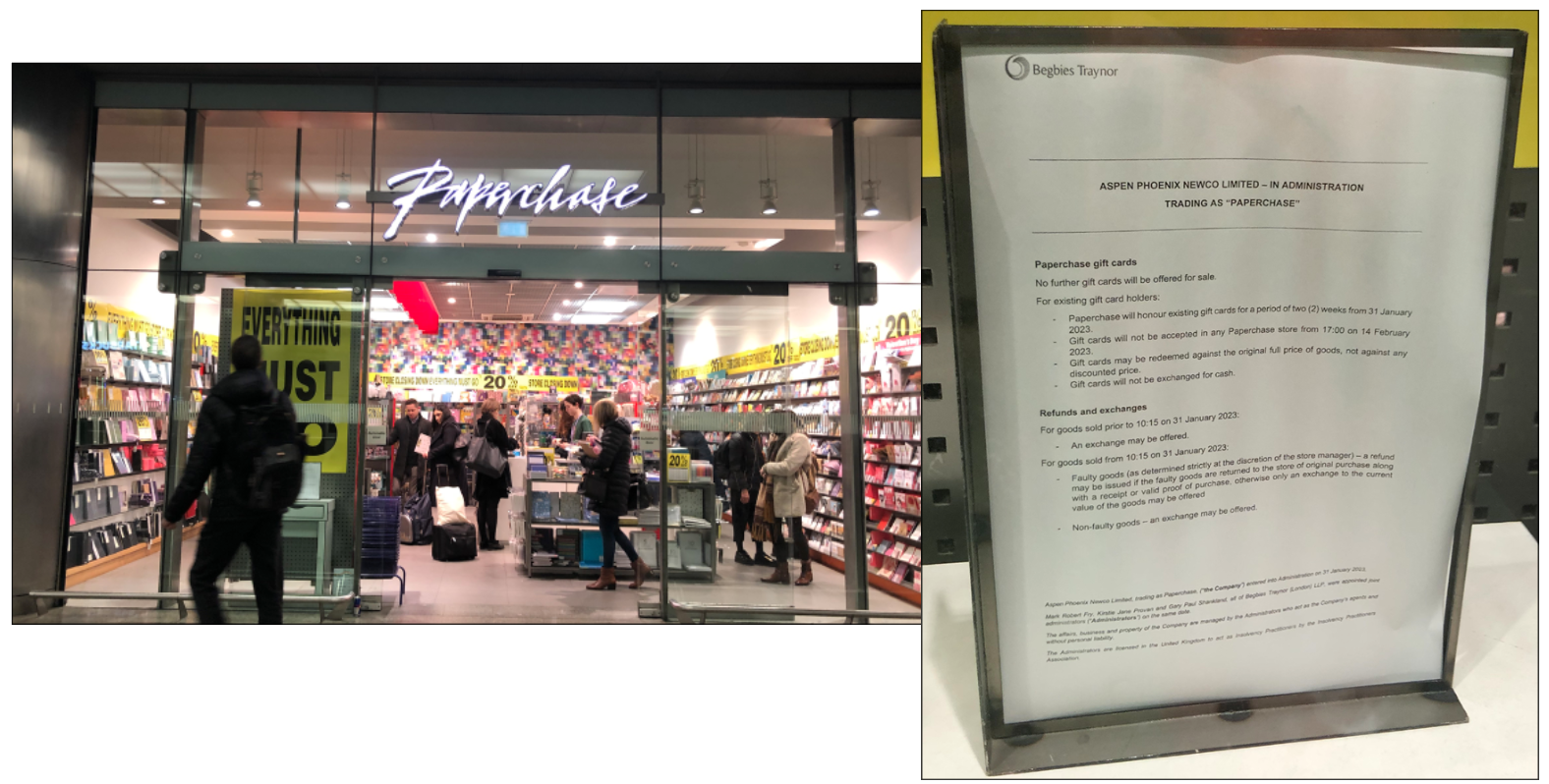

Consumers hoping to grab a bargain are currently being offered 20% off goods either in-store or online – Paperchase gift cards will be honoured until 5pm on 14 February, but only against the full cost of products, not the discounted sale price.

The pre-pack administration deal, concluded on 31 January, ended speculation about the stationery and greetings business sparked when it was put up for sale on 11 January, just four months after current owner Steve Curtis took over with Aspen Phoenix Newco running the operation.

Only six days later, 17 January, it was revealed the retailer had put professional services firm Begbies Traynor on standby to handle a potential insolvency and Tesco, the UK’s largest retailer, stepped in last week to take the IP and brand within its offer and boost its non-food proposition – but not including any of the stores or around 1,000 staff.

Designers and buyers are all looking for work and PG’s editor Jakki Brown said: “I have a list and contact details so can send on their details if anyone is interested in taking them on. It would be good to help people get jobs.”

The retail industry is now looking at what went wrong at Paperchase, which spent many years as a darling of the high street since its founding in 1968, but the recent history is somewhat chequered, having undergone a company voluntary arrangement (CVA) in 2019 to pay creditors over a fixed period, followed by a controversial pre-pack in January 2021 that left many publishers saddled with debts and understandably aggrieved that new owners Aspen Phoenix Newco – affiliated to previous owners Primera Credit – carried on selling through their unpaid-for stock.

Catherine Erdly, founder of The Resilient Retail Club, shared her view in Retail Gazette that it was “a victim of an increasingly competitive stationery market”, adding: “What was once a unique proposition – design-led stationery – became a crowded market segment with a plethora of new entrants, often at a lower price point.”

She said the stationery retail sector competition include general retailers such as John Lewis and Flying Tiger through to more specialists like WHSmith, Ryman, Smiggle, Card Factory and The Works, and added that Paperchase’s premium price points would have been hit by the push into the sector along with greeting cards by value players including B&M, Primark, Wilko, and Aldi, which all offer trend-led ranges.

In her view there are also independent stores offering a more varied and individual selection from smaller publishers, while online players such as Moonpig made a dent and value giant Card Factory continues to thrive.

Prior to the 2019 CVA the business had around 160 stores, then came the reduced footfall of Covid, the new work-from-home culture hitting High Streets, high rents and business rates, and an increasingly-squeezed margin, and Catherine Shuttleworth, founder of Savvy Marketing, told Retail Gazette Paperchase has struggled with the rising costs of running its retail business across an increasingly expensive store estate with no online presence to compete with digital-only businesses like Moonpig.

“These strategic issues, alongside a consumer who has decided to send less cards especially at Christmas and spend less frequently on non-essential items that can be purchased cheaper elsewhere, has led to its demise,” she explained.

Jan Marchant, md of home and clothing at Tesco, said of the deal: “Paperchase is a well-loved brand by so many, and we’re proud to bring it to Tesco stores across the UK. We have been building our plans to bring more brands and inspiration to the ranges we currently offer, and this will help us to take those plans further.”

And Retail Gazette also spoke to James Pow, senior retail adviser at restructuring firm Quantuma, who believes the grocer will focus on price point and look at new suppliers to reduce costs as well as strengthening the online proposition, adding: “Paperchase has a big footprint on the High Street so its brand is highly recognised. Tesco has now got this brand that has cost it peanuts, so it will be looking for sales to come through online.

“Paperchase has faced hard competition from the discounters, so the Tesco buyout will give customers another perspective – that it’s now more affordable. Customers will believe they can get Paperchase products for a lower price, especially with the Tesco Clubcard.”