Online greetings platform underpins groups ‘highly cash-generative’ performance

Moonpig is expecting to show double-digit growth and full-year revenue around £350million according to a trading performance update released yesterday, 3 April, as rumours grew over the probable sale of rival greeting card platform Funkypigeon.com.

The statement said the group – Moonpig, Netherlands-based sister platform Greetz, Red Letter Days, and Buyagift – is “highly cash-generative” as “revenue growth continues to be underpinned by strong sales at Moonpig, driven across our three core growth levers: customer base, order frequency and average order value”.

As the greetings, gift and experiences business continues to invest in technology and apps which utilise its unique data science capabilities, CEO Nickyl Raithatha said: “One in three Valentine´s Day cards created on Moonpig and Greetz featured at least one of our innovative personalisation tools, such as AI handwriting, or audio and video messages.

“We’ve been delighted with the positive reaction to our latest feature, AI-generated stickers for the inside of cards, where customers have already created over one million personalised images in just the few weeks since the launch.”

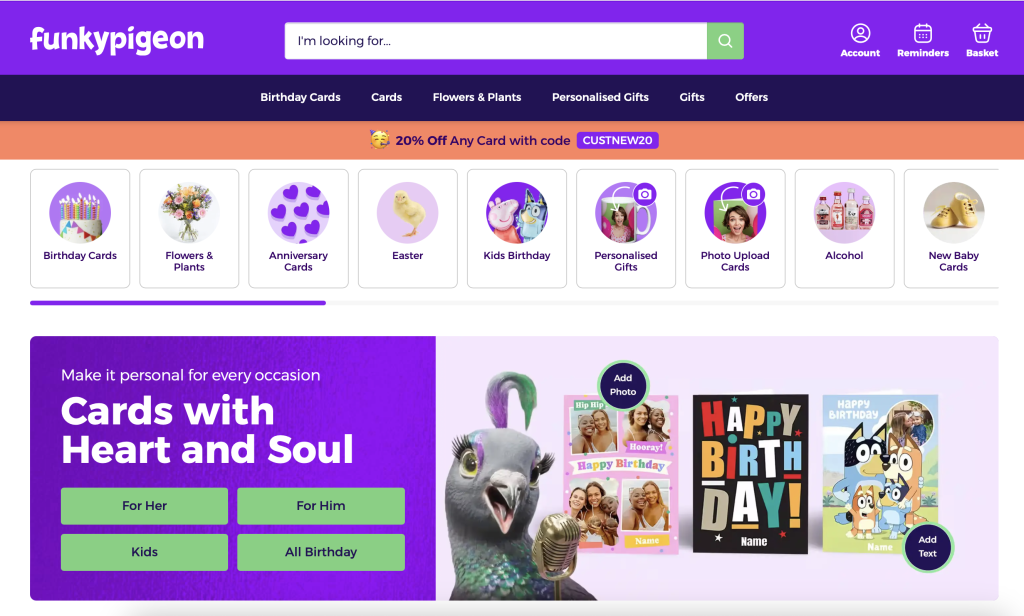

The news comes just days after WHSmith sold its High Street arm to Modella Capital for £76m – with a rebrand to TGJones – to concentrate on its international Travel business, with the company confirming: “The sale does not include the group’s personalised online greeting card business Funkypigeon.com. The group will explore strategic options for this part of the group, including a possible sale.”

Covering the trading performance for the current financial year to 30 April, Moonpig’s statement explained that full-year revenue is anticipated to be between £350m and £353m, alongside a stronger-than-expected Adjusted EBITDA margin, “which will be at the top end of our 25% to 27% guidance range, and double-digit percentage growth in Adjusted EPS”.

Greetz had a softer start to the second half of the year, but recent performance has been improving, while the Experiences arm remains focused on delivering the group’s transformation plan.

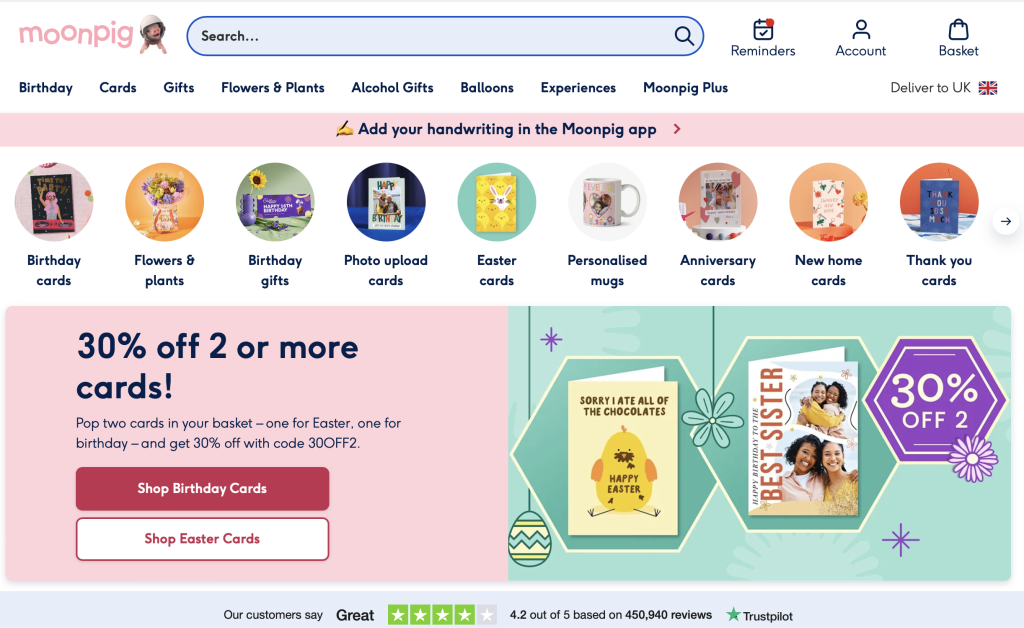

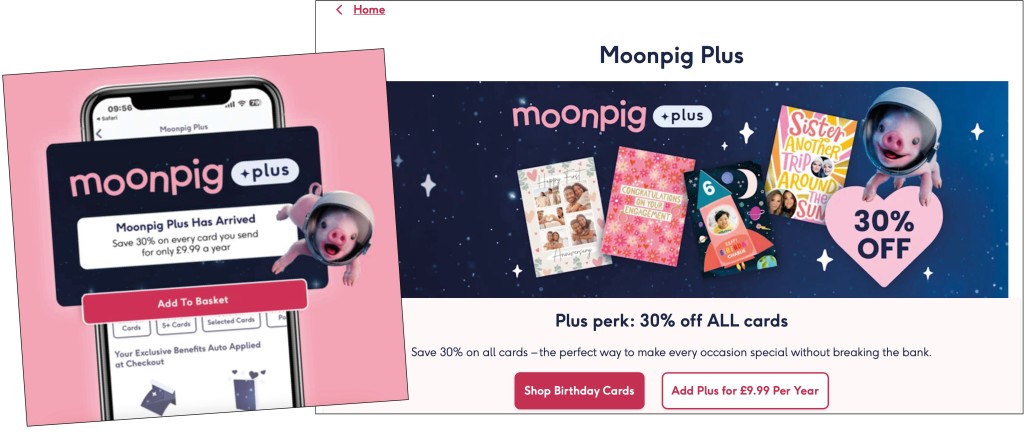

Membership of its Plus subscription scheme continues to grow, and the tracked Moonpig Guaranteed Delivery service is “now chosen for one in five card-only orders in the UK” while gift attachment rates at Moonpig and Greetz have seen strong growth in the second half, supported by enhanced recommendation algorithms and the introduction of trusted third-party brands to our curated gifting range.

Gross margin rate performance has remained strong, consistent with the first half of the year, and the statement added: “The group is highly cash generative and we continue to expect net leverage of approximately 1.0x Adjusted EBITDA as at 30 April, 2025.

“Our inaugural six-month £25m share repurchase programme is expected to complete by financial year-end. Given our continued strong free cashflow generation, the board announces its intention to start a new £60m share buyback which would commence in FY26.

Nickyl added: “We are pleased that Moonpig Group continues to deliver strong profitability and high free cashflow generation, driven by the power of the Moonpig brand. Our strong performance reflects our unique customer proposition and sustained investments in technology and data.

“By using technology, data and AI, we help our customers express themselves and connect with their loved ones, deepening engagement and strengthening loyalty.

“As we look ahead, we remain well positioned to benefit from the long-term structural shift to online and to deliver mid-teens percentage growth in Adjusted earnings per share over the medium-term.”