Plenty of opportunities to drive growth as £1.5bn industry bucks the cost-of-living crisis

Cardies had a spring in their step after a trio of speakers at Thursday’s GCA conference confirmed the resilience of the greeting card industry – with data to prove it’s bucking the downward trend of the current cost-of-living crisis.

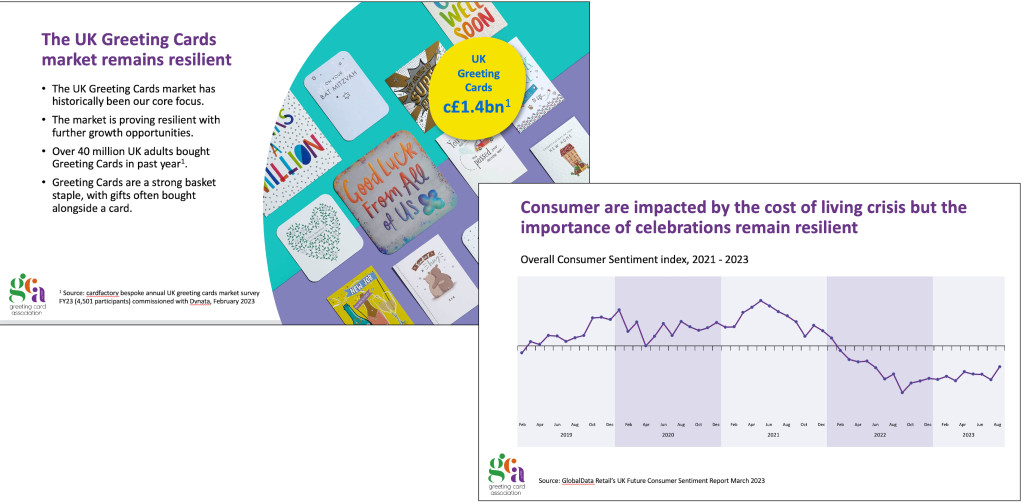

Presentations from consumer insights agency Kantar, retail giant Cardfactory and the GCA’s own annual Market Report highlighted how the industry is worth £1.45billion for single cards alone, card buyers are turning away from online sellers, and inflation is beginning to fall.

“The ONS suggests that, generally across retail, 26.5% of consumer spend is now going online,” GCA council member and Cardology co-owner David Falkner told the conference on Thursday, 28 September. “In our industry, we’re down to 11% [for online sales] this year, and the decline has been particularly keen on retailers’ websites that we’ve seen.”

David explained to the packed audience at the Royal Armouries in Leeds that 90% of the data in the GCA Market Report for 2022 – which is available for members to download free – “is directly underpinned” by responses from GCA members, with the rest is backed up by publicly-available sources.

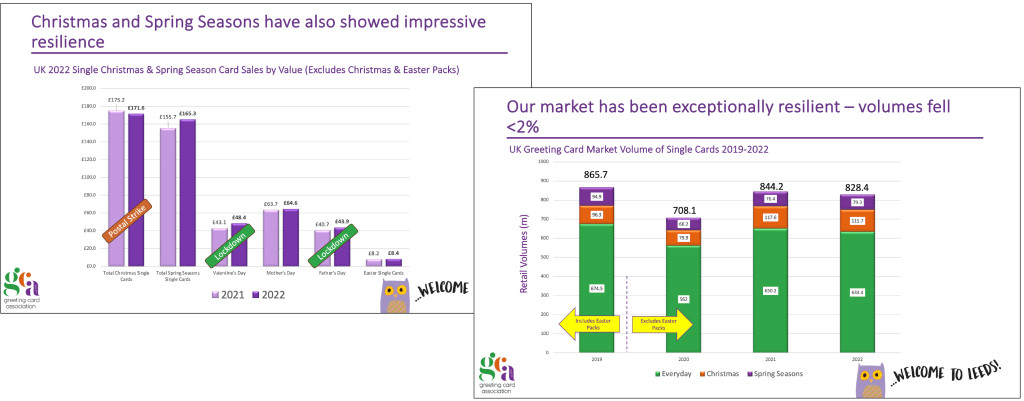

David said the association had looked back at previous years and resized the market to ensure the year-on-year comparisons are credible, and added: “The impressive thing is that we still believe the UK greeting card market to be worth over £1.45bn per year – and that’s just single cards alone.”

In an “exceptionally resilient market” volumes fell by just 2%, an “incredible number” when compared to the “post-pandemic horror shows” such as furniture which fell by 24% and outdoor by 19.6%, despite the “added complexity of the postal strikes”.

He said: “We’ve now very much got a different market. On the High Street we’ve seen some real solid performances in the value sector and in the national sector. Prices on the High Street have fallen, but the average UK single card prices stayed steady. And what’s interesting is for the 11% that is being sold online, those cards are now commanding over 85% more than their High Street equivalent.”

Kantar’s team of panellists is surveyed every three months for their perception on finances and feelings towards the current climate, where inflation is currently at 12.7% but beginning to fall.

Consumer insights director Moneeba Baloch said the panellists are then divided into three groups, the latest figures show a third are comfortable “which is growing”, and not having to restrict their spending, 42% are managing OK “and that’s decreasing, people are moving towards the managing comfortably bracket, but sadly, a quarter of the population are still struggling”.

Moneeba added: “The general merchandise area, that’s everything non-food, is in decline but, actually, greeting cards in the last year in the physical space is growing – and, among all this change and uncertainty, there are plenty of opportunities to drive growth.”

Her colleague Ni Wang drilled down more on the greetings industry: “Greeting cards have taken a very positive impact from inflation. We are only reporting cards purchased in store, and cards for the last year is at almost 1.2billion. And the competitive general merchandise (GM) card market has actually grown by 3%.

“In our July data, we are seeing that value has gone up by 9%, which is more significant compared to year-on-year data. While we do see that item price increase has contributed to this gross, the good news is we’ve also seen volume going up by almost 3% on cards.”

Ni said there were 26.7m card shoppers last year, a 1.2% increase on the previous year, who have been “visiting supermarkets to buy cards less often, and when they do they are spending much less” but “compared to that we’ve got the High Street, which consists of celebration gift shops as well as department stores, they’re doing much better, both these channels are in growth”.

On the drive to grow the industry and attract customers, Ni said loyalty programmes are having “positive impacts” and the new HFSS regulations restricting the placement of food products high in fat, sugar or salt have seen supermarkets such as Lidl, Aldi and Sainsbury’s place “inexpensive items” such as greeting cards, gift packs, and gift wraps by the till.

“It’s a very good opportunity for secondary sighting,” Ni said. “People don’t always remember that they need a card until they see it, and when people do have a gift in their basket, when they looked at the card, they might remember ‘Oh, it’s a good idea to pair it with a card’.”

Moneeba added: “The declining birth rate means considering events outside of birthdays is still really important and really relevant. And not forgetting the most important purpose for our industry, driving sentiment with our shoppers. We’re the most accessible, cheapest gifting item in our basket. We’re offering a range of wonderful cards, that drive sentiment with our shoppers, which still remains as important as ever.”

Cardfactory’s coo Adam Dury shared the value retail giant’s data which is gained from its annual survey of 4,500 respondents, now in its sixth year commissioned through Dynamic Data, where “we’re not far off an 80-20 mix between stores and online”.

He added: “We know our customers have found things tough, but celebrations remain incredibly resilient. Our view of the UK retail market, is that we believe it’s worth £1.4bn and we’ve had a view that the markets about £1.4bn for a couple of years and for first time ever, all three views from the GCA, Kantar and ourselves have come within about £80million of each other.

“We believe that 40m UK adults buy greeting cards per year, last year that equated to 73% of the nation, this year it’s 80%, again, reason to believe that more people are engaging with this category across the entire industry.”

Explaining that Cardfactory manufactures 160m cards each year in its Printcraft facility, which are sold across its 1,032 stores as well as the online shop, Adam said sales wise, the retail group now has close to a 50-50 split between cards and gifting but this will probably grow gifting accounting for 54% within three to four years.

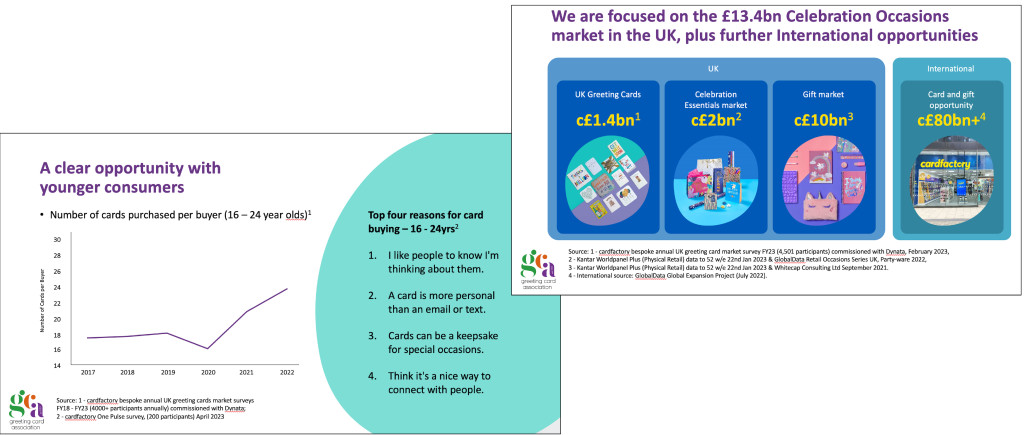

“Cards are super important,” he said, “but it’s also important you have the gifts to go with it. The whole gifting market is worth £13.4bn in the UK,” although Cardfactory is looking at a £10bn market as that covers relevant products such as soft toys, confectionery and speciality.

And the retailer has identified a clear opportunity with the younger generation, with Adam showing a slide which he described as “telling us that the younger audience are really into cards” and adding that he hoped “lots of eyes will open with huge reasons to believe, lots of optimism, a huge positivity”.

Adam added: “The 16-to-24-year-olds now have the highest cards per buyer rate, and that’s been a continuing trend since 2020. We as a business and we as an industry have a huge responsibility to work with this group and help when they come on the card journey.

“There’s clearly probably three life stages in there, secondary education, possibly university and first stages of a family, we work with that group now and think about what they’re telling us, ‘I like people to know I’m thinking about them,’ and this is their words to us, ‘a card is more personal than an email or text’ – must remind my 13 year old, because I’m sure he’s not quite there yet – ‘cards can be a keepsake for special occasions’, and ‘this is a nice way to connect with people’.

“As feedback from that age group, it’s just another brilliant reason to believe in the industry. The headline message is that we should look ahead with a huge amount of confidence.”