Aussie retail expert Brett Blundy’s investment sees Cardfactory rise to 124.60p

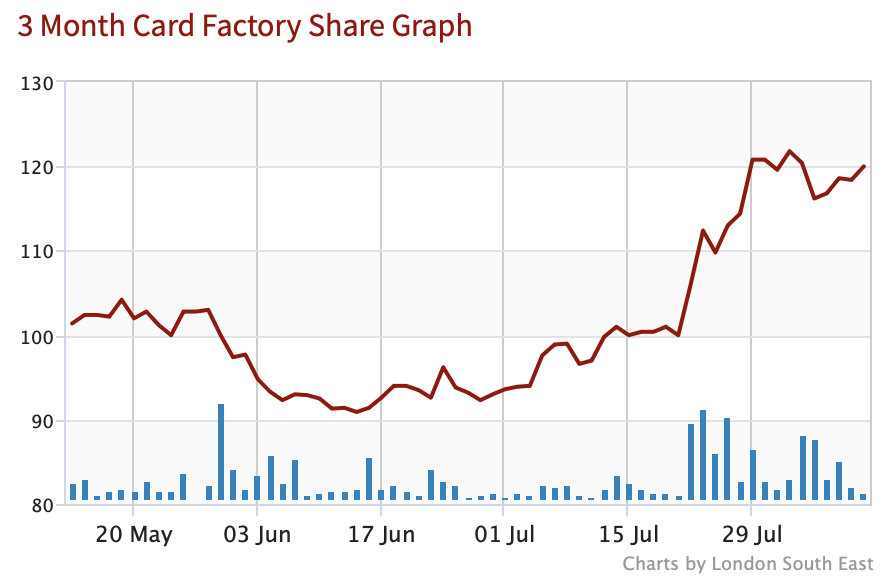

Shares in the UK’s largest greeting card retailer Cardfactory are on the rise with a 20p climb over recent weeks – following Australian billionaire Brett Blundy’s decision to buy 8.17% of the company’s listing, making him one of the retail group’s largest shareholders.

Brett is the founder of the BBRC private investment company and he is recognised as a leading global retail expert with business magazine Forbes estimating his current wealth at £1.72billion ($2.2bn).

The move, made through Brett’s BBFit Investments business registered in Singapore, makes him the third largest shareholder behind the British-based pair of Aberforth Partners with 8.984% and Artemis Investment Management with 8.572% – UK shareholders own at least 55.5% of the company.

Brett’s significant purchase followed just a few days after Swiss investment company Teleios Capital Partners sold off its entire 9.92% shareholding in the retailer.

Cardfactory has had a presence in Australia for several years, with branded concessions across leading value retailer The Reject Shop’s entire chain.

Shares in the company, which now has 1,060 outlets as well as online, are trading this lunchtime, 13 August, at 124.60p having risen by 2.64% since yesterday, making a 5.76% increase over the past five days, and 14.29% since January 1.

Cardfactory has been on a roll since reporting its positive momentum in January which delivered double digit like-for-like sales growth to £476.9million as store revenue climbed by 7.8% in November and December 2023.

And the good news was confirmed in April with the preliminary figures for the full year to January 31, 2024, showing group revenue jumped 10.3% to £510.9m, with l-f-l store sales growing 7.7% driven by a “strong store performance”, with growth in card, gifts and celebration essentials, combined with positive traction in online l-f-l sales edging up 0.4%, as the pre-tax figures rocketed 25% to £65.6m.

At the AGM in June, shareholders showed their support for CEO Darcy Willson-Rymer when he was re-elected as a director with 99.93% of the votes cast.

The company is listed as Card Factory Plc Ord 1p on the London Stock Exchange, trading with the ticker code CARD.L, and has a market capitalisation of £421.09m with approximately 346.86m shares in issue.