Data shows return to all shopping destinations – and rise is continuing

New figures from retail data specialist Springboard show there was a “slow but steady” post-pandemic recovery for all UK shopping destinations in 2022.

Overall, across retail parks, shopping centres and High Streets, the gap with pre-pandemic footfall remained significant being down 14.2% across the year, but this was an improvement from the 20.8% lower figure recorded in January 2022.

Revealing the figures yesterday, 25 January, Diane Wehrle, marketing and insights director at Springboard, said: “The question on everyone’s lips now that we are firmly in the midst of the pandemic recovery period, is what are the trends that are going to be prevalent during 2023?

“Over the decade that Springboard has been publishing its data, footfall declined by an average of 1.3% per year each year from 2009 and so, even in the absence of Covid, footfall across UK retail destinations would now be circa 4% lower than in 2009.

“Taking this into account, with all things being equal, footfall will not return to pre-pandemic footfall levels, and in 2023 Springboard anticipates that the gap from 2019 will settle at between 5% and 10% lower.”

The data shows consumer localism slowed the retail recovery in Central London, where footfall was down 17.8% on 2019 figures between May and December.

Hybrid working had an impact on High Streets, where weekday footfall remained 18.2% below 2019 levels across the year, but the gap was smaller at weekends at 11.8% below.

Meanwhile, retail parks were more resilient with footfall down just 3.7% on pre-pandemic levels – Springboard said the locations benefited from pandemic spending patterns and the fact that they were easier to reach by car during rail strikes.

And this year’s figures are already showing footfall rises with the second week of 2023 – the first complete working week – delivering a marginal rise from the week before, according to Springboard’s data.

Footfall rose across all three key destination types, however, the uplift in High Streets was nearly double that of retail parks and shopping centres, suggesting a rebound in activity and employees returning to their offices following the end of the rail strikes in the week before.

This was demonstrated by a rise from the previous week of Springboard’s Central London Back To The Office Benchmark that around four times the average for all UK High Streets, while footfall in both market towns and outer London – which are both synonymous with home working – was also higher than in the previous week, an indicator that many employees opted to work from home in what was the first time back after the festive break.

Footfall rose in all but two areas of the UK over the week, with the Midlands recording the greatest uplifts from the week that were five times as large as the national average.

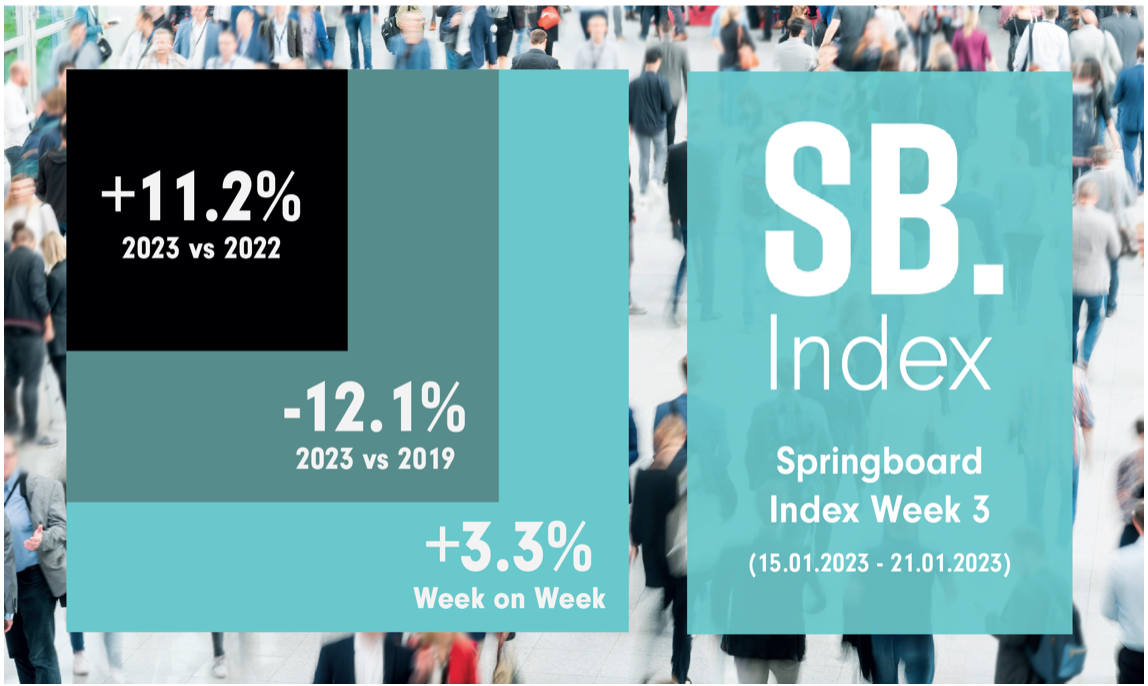

And last week, the third week of the year, saw an overall increase in activity from the previous seven days, driven by uplifts in High Streets and shopping centres although retail parks dipped.

Footfall was higher than in week two in all types of High Street, but the largest rises occurred in Central London and other city centres across the UK, while there were much smaller rises in outer London and market towns which Springboard said “is synonymous with employees returning to their offices”. This is further demonstrated by a rise in Springboard’s Central London “Back to the Office” benchmark that was a fifth higher than the rise in footfall in Central London and in cities outside of the capital.

All UK geographies benefited from an increase in footfall over week three with five areas recording uplifts that exceeded the average for the UK as a whole and, in Scotland, the rise was more than double the UK average.

Top: Workers’ return to the office is helping High Streets