Royal Mail’s parent company rejects £3.2bn takeover from billionaire, GCA keeps up pressure

A year after increasing his stake in Royal Mail’s parent company, Czech billionaire Daniel Křetínský has returned with a £3.1billion takeover bid for what he termed “an important national asset” – and is looking to negotiate after the cash offer was rejected.

Saying he is “prepared to support this iconic business as it transforms and rebuilds into a modern postal operator”, the former lawyer is already the biggest stakeholder in owner International Distributions Services (IDS) with 27.6% of shares through Vesa, a Luxembourg-based investment vehicle of the EP Group he controls.

And on Wednesday, 17 April, the group issued a statement through the London Stock Exchange confirming it had submitted a “non-binding indicative proposal” to the IDS board seeking its recommendation for a possible cash offer for the entire remaining issued, and to be issued, share capital.

The statement added: “While EP Group’s proposal was rejected by the board of IDS, it looks forward to continuing to engage constructively with the board as EP Group considers all its options.”

Viewing the UK as “an attractive and dynamic market for investment”, the man nicknamed the Czech Sphinx due to his inscrutable demeanour, who also owns a 27% stake in West Ham football club and 10% of Sainsbury’s, is actively casting his eye over prospects for the 508-year-old Royal Mail, adding EP Group “is proud to support the businesses in which it invests”.

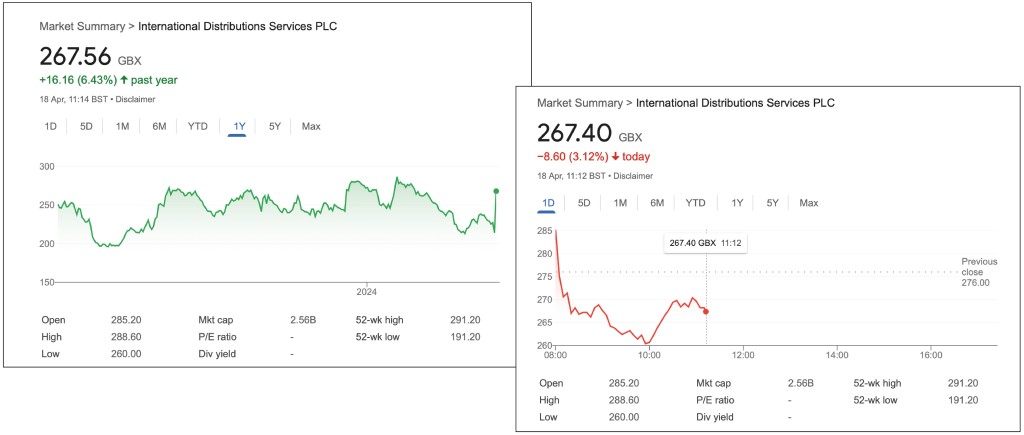

IDS confirmed it had rejected the 320p per share offer which valued the business at £3.1bn and the bid helped the parent company’s shares rise to 276p on Wednesday, up 61.08p or 28.85%, raising the value to £2.6bn, a significant increase as the value had fluctuated wildly over the past year following the industrial action at Royal Mail over Christmas 2022 and the delivery company’s poor performance generally followed by the current rows over continuing the universal service obligation (uso) and continuing stamp price rises.

The statement continued: “EP Group recognises that Royal Mail is in a challenging situation. Weak financial performance, poor service delivery and a slow transformation, in the face of a market going through structural change, have put the business under unsustainable pressure. With the increasing competition from multinational companies in the UK postal market, private investment in Royal Mail becomes crucial.

“EP Group also recognises that Royal Mail is an important national asset that would benefit from being able to take a longer-term view and is prepared to support this iconic business as it transforms and rebuilds into a modern postal operator delivering high-quality service to its customers, stability to its workforce and sustainable financial performance.

“As a committed long-term investor in the UK, EP Group recognises the importance of the Royal Mail business to its various stakeholders, including employees, trade unions, customers and government, as the UK’s sole designated universal service provider. EP Group has submitted its non-binding indicative proposal to IDS with the interests of these important stakeholders in mind.”

Although pointing out the announcement and rejected proposal “does not constitute an announcement of a firm intention to make an offer”, it is understood business analysts expect further interest from EP Group with a deadline of 15 May for another offer.

The takeover approach comes as Royal Mail, under group chief executive Martin Seidenberg, is battling opposition from across the greeting card industry as well as the government and general public to its attempts to reduce the USO whereby it must deliver letters across the UK six days a week for the same price.

There has been widespread condemnation of the fourth above-inflation stamp price rise in two years, as well as the bid to slash letter deliveries to five or even three days with a more expensive option retained to allow for next-day deliveries, which appeared to be supported by industry regulator Ofcom in its The Future Of The Postal Service review.

Royal Mail has now proposed second-class deliveries on alternate week days while keeping the six-day first-class letter post – but with no cap on prices – which it claims would keep it within the USO while cutting up to 1,000 jobs and saving £300million a year.

The GCA is continuing its campaign to safeguard a reliable and affordable postal service and is further strengthening links with mps, government ministers and interested bodies as part of this.

The trade association urges everybody in the greeting card industry to do their bit, for the good of the greeting card industry and society as a whole.

There is a comprehensive blog on the GCA website with an updated letter template which publishers, retailers, trade suppliers and agents can download and adapt before sending to their ops, with an mp lookup facility within the blog.